The Federal Reserve chair person Janet Yellen reiterated that US rates are likely to increase sometime this year. The July Beige Book also kept sentiment toward USD strong. CAD and NZD were among the underperformers after BoC's rate cut and a further slump in dairy prices at Fonterra's auction. The dollar surged to its highest level in a week after Yellen sent strong indications that economic conditions are likely to justify an interest rate hike at some point this year.

EUR has lagged despite the passing of the omnibus bill by an overwhelming majority in Greece parliament. However, fresh cracks in the government appeared, with the resignation of deputy finance minister Nantia Valavani over the bailout. To counter increasing rebellion within his party, media report that Tsipras is expected to announce a cabinet shake-up today.

In addition to that IMF commands and threatens to pull out on back of European Commission issued its own forecasts of debt to GDP ratio which has been poor for years to come. The IMF's debt sustainability analysis of Greece puts euro at stake back again.

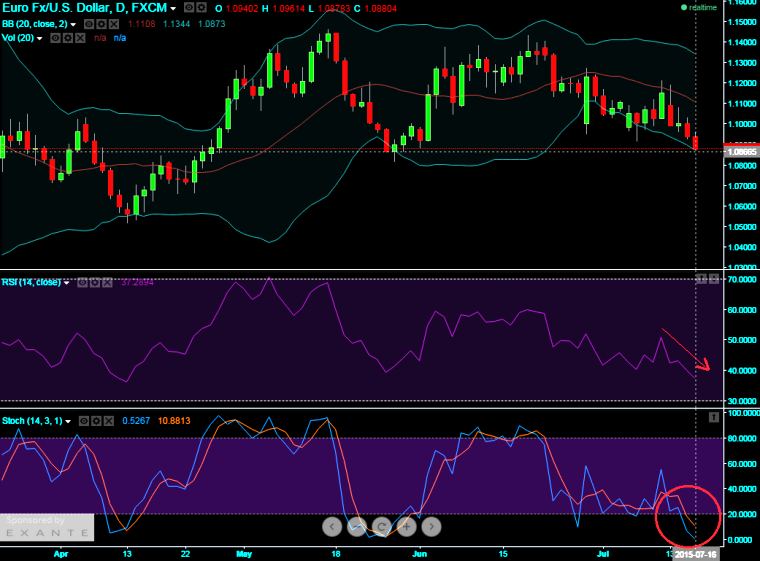

Technical Roundup: (EUR/USD)

EURUSD case is exactly opposite to what we explained of USDCAD pair earlier. Here, we traced out bearish sensation is continuing as the %D line crossover on slow stochastic arrives below 20 levels while RSI (14) converges the price dips. The pair has opened today by breaking strong support at 1.0935 levels. We can see next strong support only at 1.0807 levels.

Greece issues still weigh on EUR, while USD remains robust

Thursday, July 16, 2015 12:19 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand