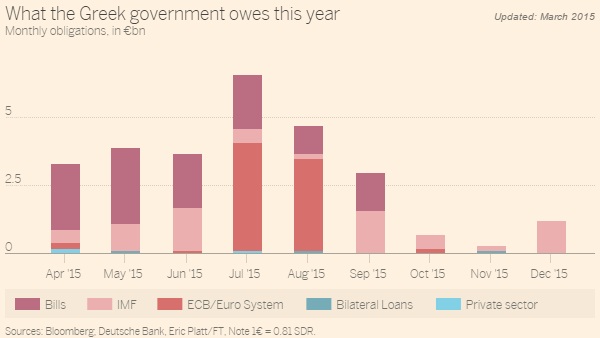

This fantastic chart from financial times above, explains Greece's liabilities this year towards IMF, ECB, bill refinancing, bilateral loans and private sector.

IMF and ECB are the two largest creditors, whose payment is due this year. Greece owes ECB of around € 7.2 billion during July and August 2015.

Negotiations over these has remained hot in Euro zone finance ministers' meet with Greek counterpart.

- On a separate note Greece has successfully auctioned six month treasury bills at average yield of 2.97%. Bid to cover ratio for the sell was 1.3, lowest since 2006.

However it looks like that Greece will successfully be able to refinance € 1.4 billion and T- bills due on April 14th and will be able to honor its obligation of € 450 million towards IMF tomorrow.

- Focus now will be on the next tranche of payment worth around €950 million towards IMF in May along with €2.4 billion payments towards salaries and pensions.

Euro group finance ministers will reconvene on 24th April at Riga to resolve Greek crisis.

Weaker Euro has been cheered by many countries and companies in the Euro area, however for Greece, as of now it is a curse in disguise.

- Near 25% fall in value of Euro since last year, has actually increased Debt burden of Greece towards IMF, SDR (Special drawing rights, a unit used by IMF) now costs more in terms of Euro.

Euro till 24th will be looking beyond Greece for directions. Euro is currently trading at 1.085 against dollar, up 0.20% today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary