Hungarian growth eased to 2.7% y/y in Q2, raising concerns. But lowering the base rate will probably not help because bank lending has declined with banks' balance sheets under financial pressure from the bank levy, loan conversions and loan refunds.

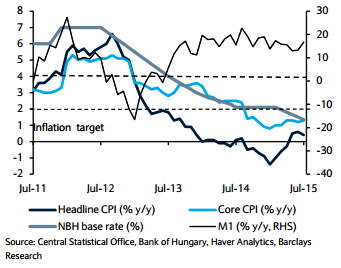

"Hungary is expected to remain on hold next week at 1.35%. Although headline inflation at 0.4% y/y in July is quite low compared to the 2-4% target, core inflation at 1.3% y/y is approximately equal to the base rate", says Barclays.

Furthermore, the demand for loans remains weak.The NBH and government are expected to try to boost growth through quantitative easing and unorthodox measures. Another conversion of FX denominated loans (this time for cars and consumer loans, much smaller than the mortgage conversion) is being implemented that will close the issue.

Hungary's steady monetary policy

Friday, August 21, 2015 5:46 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed