After starting the week in Strong footing Dollar was pushed back after PCE data revealed consumers refrained from increasing spending, while personal income improved.

- PCE details from US indicated that personal income increased by 0.4% on monthly basis in April but expenditure remained flat. Core PCE price index (FED's favorite inflation indicator) rose by 0.1% m/m in April lower than 0.2% expected. Reading was weaker than prior on yearly basis growing only 1.2% compared to 1.3% prior.

Euro is trading back at 1.097, after falling as low as 1.089, similarly Pound is up, trading at 1.526 from 1.519.

Dollar is now looking forward to ISM release at 14:00 GMT, followed by Markit manufacturing PMI at 13:45 GMT.

Past trends -

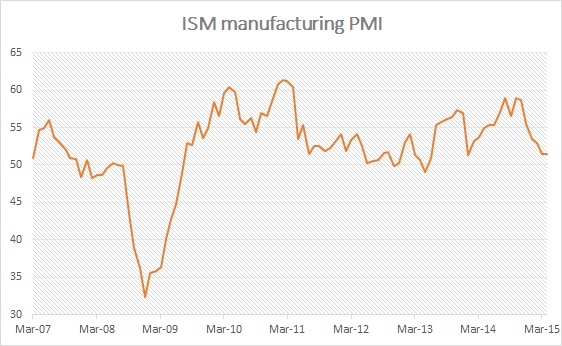

- 2014 has been strong year for US, when ISM PMI reached as high as 59 in October. However growth has been lagging since then. ISM PMI still remains in expansionary territory but growth rate reached lowest level since January 2014, facing headwinds from stronger dollar in first quarter. Moreover lower commodity prices have pushed back investments in the mining sector leading to job losses there.

Expectation today -

- Market is expecting improvement today. Median estimate for ISM manufacturing PMI stands at 52.

Stronger reading would indicate that weakness in the first quarter to be temporary, whereas weaker reading would push back rate hike expectations, thus pushing yields and dollar lower.

Dollar index is trading at 96.97, down from 97.51.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate