In a risk scenario, if the BoJ could ease by raising the pace of targeted monetary base expansion by ¥10-20tn/year, primarily by increasing purchases of JGBs (quantitative easing).

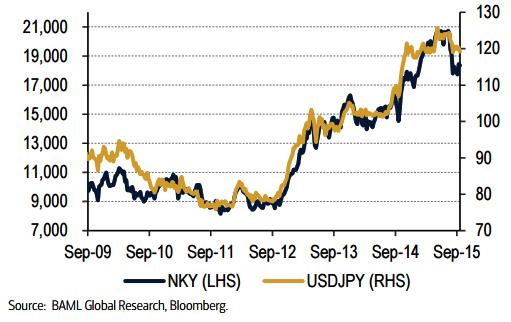

Also, the qualitative aspect of easing may be more pronounced than the quantitative aspect this time. An expanded BoJ monetary easing would likely cause USD/JPY to clearly recover the uptrend with 125 increasingly likely before the year's end, due to an expectedly higher Japan-US monetary base ratio, a wider US-Japan long-term yield spread and the signaling effect.

Last year, USD/JPY rose by nearly 10% in the weeks following the BoJ's decision to expand QQE. The next round of extra easing could well match the scale of last year in terms of its quantitative expansion, but we expect the USD/JPY reaction to be somewhat less dramatic (though still significant).

This is because the GPIF also surprised the markets by announcing its new basic portfolio on the same day last year, last year's BoJ announcement came as an almost complete surprise, and uncertainty persists about divergence of US and Japanese policies as any easing would come amid diminishing expectations of a US rate hike and a sluggish global macro environment.

Also, because of the strong focus on qualitative easing and undervaluation of JPY, the impact on USD/JPY may be less pronounced than on Japanese equities. But USD/JPY and Japanese share prices remain positively correlated, so higher equity would be positive for USD/JPY as risk sentiment improves.

"Positions are also light, and the potential BoJ easing measures would probably still wield enough of a surprise effect. But the long-term risks of any further easing need to be kept in mind because of the possibility QQE's days may be shortened, as well as growing criticism of the side effects", says Bank of America.

If BoJ expands QQE, USD/JPY rises toward 125 sooner

Thursday, October 29, 2015 6:39 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX