Concerns about China growth, the competitiveness challenge and the potential disinflationary effect of CNY devaluation on import prices have all pushed EM FX weaker. Although a large share of Asia's exports to China are likely intermediate goods (average of 62% based on WTO estimates), some EM Asia economies still stand out as having significant exposure to Chinese demand (nonintermediate goods exports as a % of GDP). The KRW and TWD look vulnerable in this respect.

"We expect a continuation of accommodative monetary policy and tolerance for FX depreciation in EM Asia", notes Barclays.

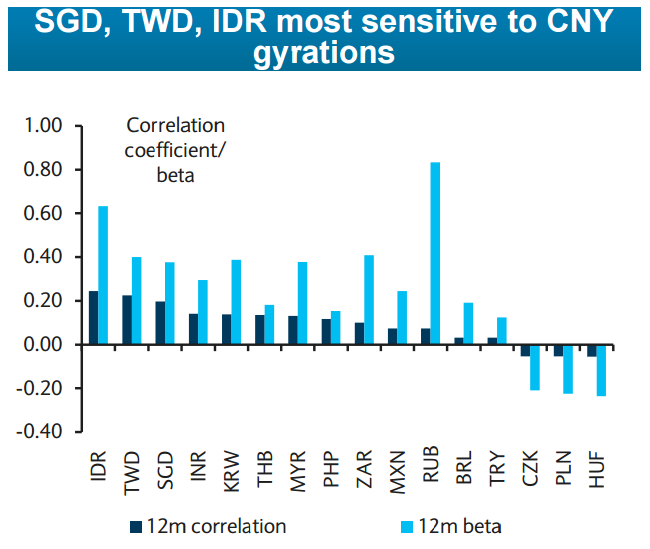

In terms of FX sensitivity, Asian currencies are, unsurprisingly, the most susceptible to CNY depreciation, with the SGD, TWD, and IDR most correlated with the CNY over the past 12 months

Impact of China’s FX policy on EM Asia FX

Thursday, September 24, 2015 10:56 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX