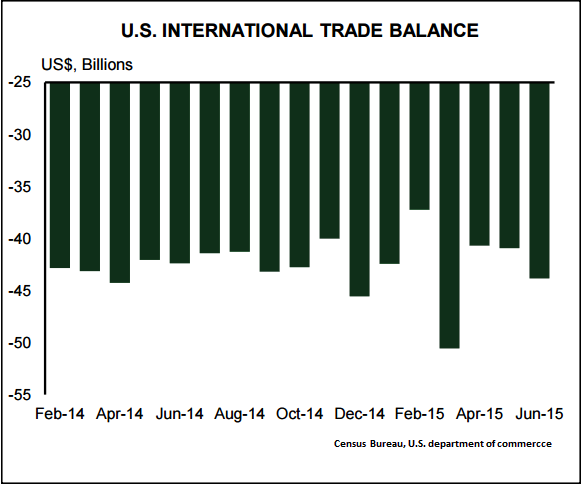

The US trade deficit is projected to turn down remarkably in July, narrowing to $41.81B from $43.84B the month before, with import activity falling on account of falling energy prices while export activity should rise modestly. This will mark the first improvement in the deficit since April.

Earlier post was up about $2.9 billion from $40.9 billion in May, revised. June exports were $188.6 billion, $0.1 billion less than May exports. June imports were $232.4 billion, $2.8 billion more than May imports.

But this time, export activity should rise on the month, posting a 0.4% MoM advance, bolstered in large part by improving global demand. Import activity is likely to decelerate by 0.55% MoM in July as the continuation of the decline on oil prices dampens the import bill.

In the coming months, we expect the improvement in the trade balance to be sustained as lower energy prices continue to keep the energy import bill low, but expect a stronger USD to weigh on exports.

Release Date: September 3, 2015 June Result: -$43.8B TD Forecast: -$41.8B Consensus: -$44.5B.

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar

Chinese Yuan Edges Higher but Faces Biggest Weekly Drop in Over a Year Amid Strong Dollar  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume

Trump Praises Delcy Rodríguez as Venezuela Oil Exports Resume  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion