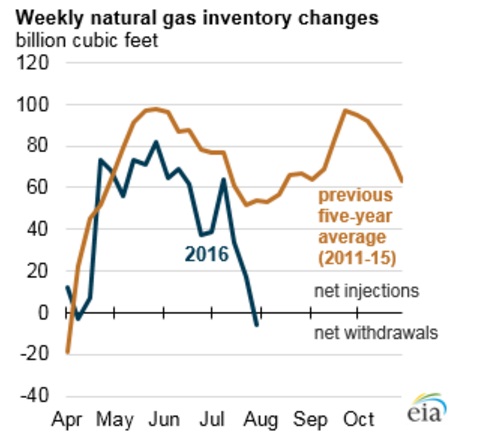

For the week ending 29th of July 2016, natural gas inventories posted a surprise drawdown, a net withdrawal of 6 billion cubic feet. Increased demand for natural gas as a source of power generation is neither surprising nor unprecedented but according to the data available from Energy Information Administration (EIA) of United States, the last time such a net withdrawal occurred was back a decade ago. See Chart 1 from EIA.

Though higher inventories have remained a major concern for the natural gas bulls, it is important to note that the injections during the current injection period have been much lower than its five-year average. Production of natural gas has been increasing for the past decade but the growth has fallen in recent days, whereas a move towards cheaper and cleaner fuel has led to higher demand, especially from the power generating companies. Typical injection period is from April to October when production surpasses demand and the natural gas gets stored in underground storages.

The data from EIA also show that the use of natural gas for power generations has hit a record high this year. Consumption of natural gas for power generation has been very high throughout 2016, but on July 21st, it has hit record high level of 40.9 billion cubic feet. See chart 2 from EIA

We have remained a natural gas bull for quite some time now and expect the gas price to reach as high as $4.3 per Mmbtu from current $2.73 per Mmbtu, though there could be further drop in the near term.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX