Industrial production of India declined during the month of October, owing to high base effects amid slump in manufacturing and mining activities. Following the government’s demonetization move, the country is expected to witness a further decline in the indicator.

India’s industrial production declined -1.9 percent y/y in October, faster than -0.9 percent registered in Q3 2016. Manufacturing and mining activity slumped in the month, with electricity generation contributing to the headline with a 1.1 percent y/y rise.

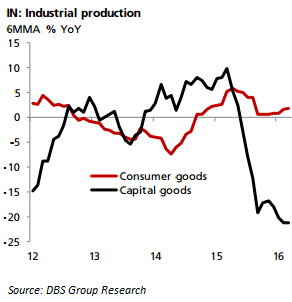

On the use-based end, capital goods extended decline at -26 percent y/y, from -24 percent in Q3, while consumer goods production was a mild negative on slower non-durables output. Thus far in FY16-17, industrial production growth has averaged -0.3 percent compared to last year’s full year’s pace of 2.5 percent.

Since the demonetization initiative, auto sales slumped in November, as discretionary incomes and consumers’ purchasing power was under strain due to the cash shortage. October manufacturing PMI rose to a two-year high on new domestic orders while exports moderated. Novemeber PMIs have since moderated.

These factors suggest that weak October numbers are likely to stretch into November. Incoming data will remain important to gauge the true fallout of the banknote ban on economic activity, after the RBI assumed a transitory impact in its projections earlier this week.

"We look for annual IP growth to average 1.0-1.5 percent this year with downside risks vs 2.5 percent last year. Nov inflation numbers, due tomorrow, are likely to ease further, undershooting the central bank’s projected path," DBS commented in one of its recent research note.

Meanwhile, the USD/INR traded at 67.56, up 0.12 percent on the National Stock Exchange.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record