After soft economic data, pointed at turning sentiment among consumers and businesses, today hard data showed India's manufacturing sector is reversing its downtrend.

Reforms pursued by New Bharatiya Janata Party (BJP) led government and prudent monetary policy by Governor Raghuram Rajan of Reserve bank of India (RBI) seem to be succeeding in bringing back growth to Asia's largest democracy.

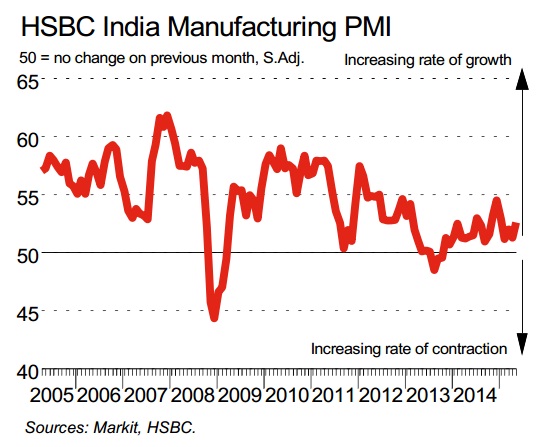

- According to HSBC India manufacturing PMI, manufacturing sector gathered further pace in May, with headline figure reaching to 52.6, highest in four months.

- Manufacturing output increased for 19th consecutive month and output increased in May at fastest pace since January, 2015.

Despite the improvement, all is not rosy.

- So far for manufacturing sector, it has been almost jobless recovery. Employment in the sector has lagged recovery so far.

- Manufacturers have reported higher purchasing costs and input price inflation has quickened during May.

Nevertheless India seems to be returning to its former glory and investors overall remain bullish on India. While foreign portfolio investors, doubts India's capability as country's benchmark nifty index gave up earlier gains and up by only 2% this year, direct investors have poured in $40 billion as investments in the country.

India Rupee have performed well in last few trading days, gaining against dollar, however any large gains unlikely, since RBI is buying up dollar in a bid to keep Rupee stable when US federal Reserve hike rates.

INR is currently trading at 63.6 against dollar, up 0.3% for the day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary