India’s Reliance Industries is offering to sell a 40 percent stake in its retail arm Reliance Retail for $20 billion to Amazon.com Inc.

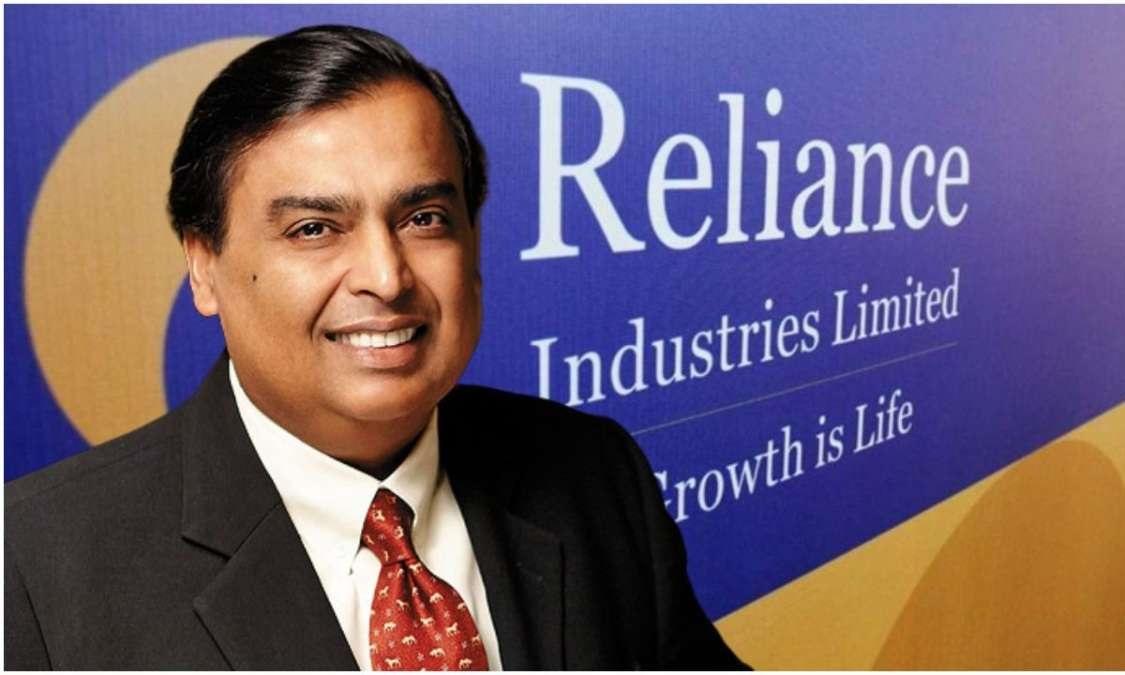

Amazon has made no decision but had held talks with the Mukesh Ambani-led firm and expressed interest in negotiating deals.

A stake in Reliance Retail could give Amazon access to the Jio telecoms platform and its vast retail footprint across India.

Reliance Retail, which had close to 12,000 stores selling extensive types of products, had already raised $20 billion this year by selling nearly 33 percent of its Jio Platforms business from investors, such as Google and Facebook.

It just announced receiving a $1 billion investment from Silver Lake Partners.

Last month, Reliance Retail acquired rival Future Group’s retail arm.

Asia’s richest man, Ambani is focusing on attracting more investors to Reliance Retail as it prepares to take on the likes of Walmart Inc’s Flipkart and Amazon.com Inc’s Indian arm.

Among those weighing potential investments are Abu Dhabi state fund Mubadala Investment Company and Saudi Arabia’s Public Investment Fund, which are both backers of Jio Platforms.

Among those weighing a potential investment are Abu Dhabi state fund Mubadala Investment Company and Saudi Arabia’s Public Investment Fund, which are both backers of Jio Platforms.

Shares in Reliance increased as much as 8.5 percent on Thursday to become the first listed Indian firm to reach a market capitalization of over$200 billion.

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing