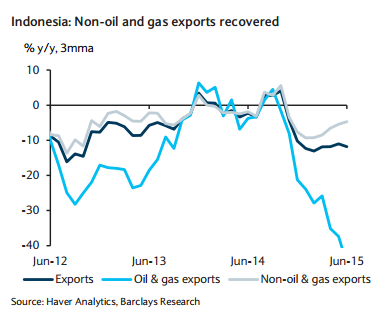

Indonesia's June trade report pointed to some signs of stabilisation, consistent with China's better-than-expected June data. Indeed, the contractions of exports and imports eased markedly, with growth falling by 12.8% (5.9% m/m; May: -14.4% y/y) and 17.4% (11.6% m/m; May: -21.4% y/y), respectively. The release brought the YTD trade surplus to USD4.4bn, the highest since 2011.

Barclays notes:

- We continue to expect manufacturing shipments to improve in the coming months.

- With inflation trending above BI's target range in Q2-Q3, and given growing concerns about the IDR's vulnerability, we believe there is a strong case for BI to remain on hold this year.

- The focus will turn to speeding up infrastructure spending, which should drive growth in H2. We believe the growth dividend from infrastructure spending will make a significant contribution from 2016 onwards and should keep growth in 2015 marginally above 5% (Barclays: 5.1%).

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022