- Latest data suggest that consistent FED over the rate hike this year might be succeeding to anchor the inflation expectation over the longer horizon.

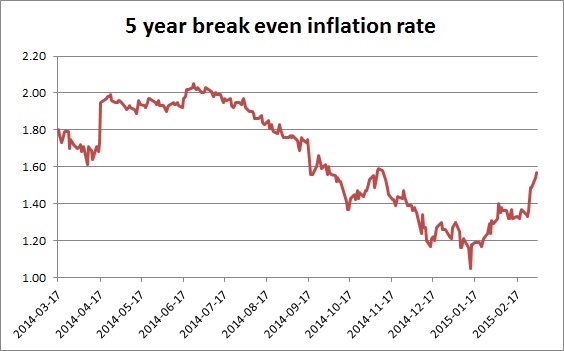

- 5 year break even inflation rate as shown in the chart is rising much faster rate after falling to the lowest point in January.

- The rate has jumped nearly 50 basis points after making a low in of 1.16 percent in January.

- Similarly other measure like 5 year, 5 year forward inflation expectation is hovering near 2.20 percent after similar slump below 2 percent in January.

- Similar trend can be seen in 10 year break even inflation rate, hovering near 2 percent.

- As argued before, FED could be pushing the inflation expectation through forward guidance affecting the term premium.

- Such success could be short lived if actual inflation as measured by CPI, PCE, PPI etc. fail to arrive.

Impact -

- Latest push of the dollar against the currencies could be partly fueled by the above expectation anchoring and rise.

- Under such circumstance dollar is expected to strengthen further and yields firmer over the medium term.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand