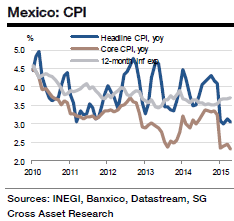

Mexico's inflation slipped below 3.0% (the Banxico's target) in May for the first time in a decade and slid even further since then, as core inflation remained at its lowest level ever at 2.3% and food inflation fell to its lowest levels in 14 months. The key component of core inflation - dwellings - saw price pressure slows further in July, down to 0.45% yoy. This presents some downside risk to the existing view that core inflation has bottomed.

Moreover, it is difficult to factor in a significant rise in core prices, going forward, given the low wage pressure and the substantial output gap while MXN passthrough remains low. The bi-weekly series for end-July is likely to report annual inflation at 2.70% yoy, says Societe Generale.

Inflation is expected to revert to its medium-term trend in 2016 when the base effect of lower telecom and energy prices ebb.

"Broadly, the inflation situation remains conducive to the Banxico's current accommodative stance, and growth and Fed's policy stance are likely to be the key factors in monetary policy decisions over next couple of quarters. Following recent developments, 2015 inflation forecast has been revised down to 2.9% from 3.2% and 2016 inflation forecast is risen to 3.5% from 3.4%", estimates SocGen.

Mexican inflation falls further as core prices remain weak

Monday, August 24, 2015 4:31 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022