In the previous month, precious metals prices have diverged within themselves,

The palladium and platinum slid by 10% and 2% MoM respectively, while gold and, to little extent, silver benefited from safe-haven demand on the back of the turmoil in global equity markets and escalating tensions in the China and Middle East.

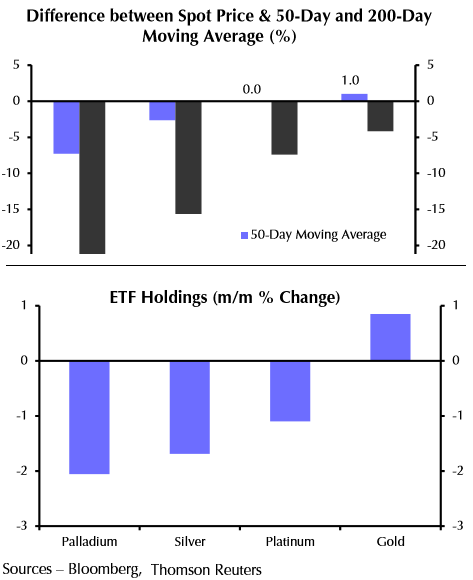

From technical perspectives, precious metal market outlook has somewhat improved. While all metals are trading well below their 200-day moving averages, gold and silver have broken above their 50-day moving averages, but don't the jump the guns, a better clarity for long term bullish signal for prices should be awaited.

Meanwhile, the ratio of gold/platinum spiked from about 1.25 to 1.30, shifting further away from its long-term average of around 0.8 as platinum underperformed gold.

However, we saw deviation in the futures markets sentiment quite sharply from last month. Gold and silver observed an increase in their net long positions as they benefited from safe-haven demand (see diagram) with risk reversal turning into neutral from the negative for 1 week's contracts.

In contrast, sentiment towards palladium soured, with net longs falling by 47% m/m. Gold underwent the biggest change in sentiment in the futures market, where net non-commercial long positioning increased by 138%, as short bets were cut by 19%.

Most precious metals ETFs saw outflows last month: Gold ETFs bucked the trend (see diagram), with assets under management increasing by about 1%, on safe-haven demand. Palladium and silver ETFs were the worst performers, recording five consecutive weeks of outflows.

Is yellow metal really a safe-haven among precious metals? ETF outflow baffles

Monday, January 25, 2016 1:25 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?