Italian Balance of trade: Italy recorded a trade surplus of 4060 EUR Million in March of 2015 as BoT in Italy is reported by the National Institute of Statistics (ISTAT). It has been consistently reporting trade surplus in Italy. If there is any significant gap between country's imports and exports within reporting period would be accounted in balance of trade. A positive number indicates that more goods were exported than imported. This is one of the few non-seasonally adjusted numbers reported on the calendar, as it's the primary calculation for this indicator

German's bundsbanks monthly report: it is scheduled to be released today. It indicates current and futuristic economic situations from bank's perspectives. Market impact tends to be greater when the report reveals a viewpoint that clashes with the ECB's stance

Zew's economic sentiment index: The index numbers for May month are scheduled to be released tomorrow. Zew Economic Sentiment Index in Germany decreased to 53.30 in April of 2015 from 54.80 in March of 2015, below market expectations.

An eye on Technical & Derivatives: (EUR/JPY)

On intraday charts we traced out hammer candlestick pattern occurred which is bearish signal. Long shadow with small real body indicates the weakness in this pair. And in addition all signs of occurrence of shooting star on daily chart are most likely. To substantiate this bearish stance stochastic evidences %K line exactly above 80 levels, this indicates an overbought situation.

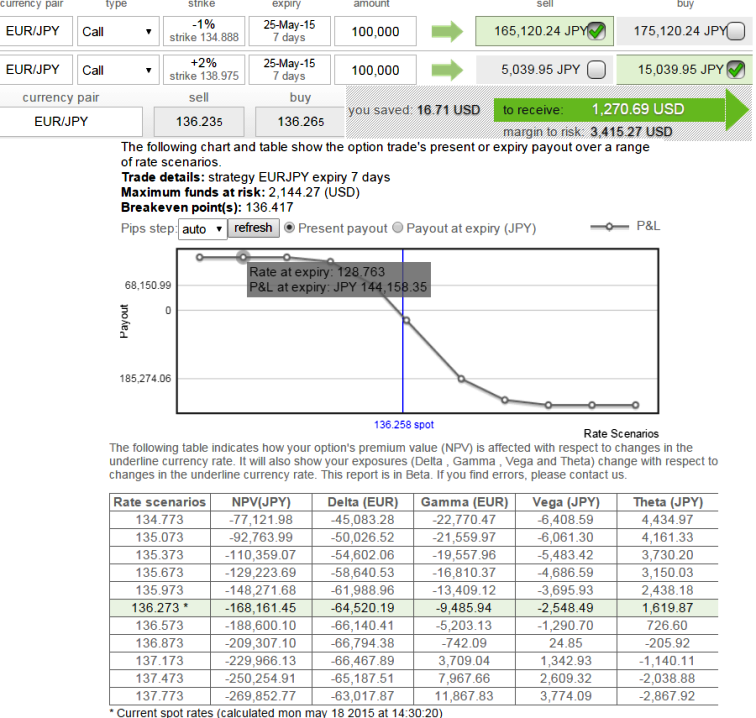

Option strategy: Bear Call Spread

As we are sensing early signals of downtrend on this pair, we devise hedging patterns to safeguard the probable downswings.

In order to execute this strategy, one has to sell a Call (ATM or ITM) and purchase another Call at a higher Strike Price (OTM) for a net credit.

Use this strategy when you expect the underlying currency to move lower or sideways so that the calls expire worthless and you keep the entire premium. A Bear Call Spread is better over Short Call since it has limited risk unlike unlimited risk in case of Short Call.

Keep a short time to expiration to take advantage of the time decay and give the Stock less time to go against you.

Italy posts consistent trade surplus but not suffice to propel Euro, hedge potential slumps

Monday, May 18, 2015 9:08 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?