The Japanese 10-year government bonds hit a fresh all-time low of minus 0.14 percent on Friday, following global debt prices as investors wary ahead of potentially seismic events this month including Britain’s referendum on European Union membership, Bank of Japan and the Federal Reserve meeting. Also, weak equities and tumbling crude oil prices drove investors towards safe-haven buying.

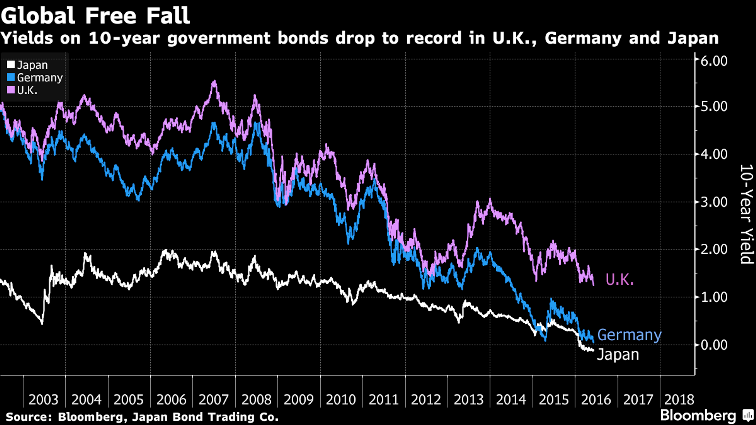

The yield on the benchmark 10-year bonds, which moves inversely to its price fell near to 2 basis points to -0.141 percent, yield on super long 40-year bonds also dipped more than 1-1/2 basis point to 0.333 percent and the yield on short-term 2-year bonds tumbled 2 basis point to -0.267 percent by 07:00 GMT.

In the global debt market, the benchmark 10-year US Treasury note yield fell near to 3 basis points to 1.678 percent mark for the first time since February. The German 10-year bund yields fell to a new record low of 0.034 percent, after testing its 2015 low of 0.05 percent and it likely to test zero next week.

Moreover, the JGBs have been closely following developments in oil markets because of their impact on inflation expectations, which are well below the Bank of Japan's target. Today, crude oil prices fell on a stronger dollar, after jumping beyond $51 mark on Thursday. The International benchmark Brent futures fell 0.83 percent to $51.52 and West Texas Intermediate (WTI) dipped 1.03 percent to $50.04 by 07:30 GMT.

On Thursday, Bank of Japan Deputy Governor Nakaso said that Japan's economy is expected to expand moderately and he expects 2 percent inflation target to be hit in fiscal 2017/18. He further added that it takes some time for the effect of monetary policy to appear in an economy and there is absolutely no change in BoJ's commitment to hit 2 percent inflation target. the BoJ will take additional steps if needed to hit price goal and no easing in April does not rule out any further action, he added.

Bold easing is necessary to put the economy on track for sustainable growth and some indicators suggest a fall in bond market liquidity since the start of the year, he added.

In addition, Bank of Japan Governor Haruhiko Kuroda will make a decision on stimulus on June 16 and the Federal Open Market Committee (FOMC) gathering scheduled for June 14-15. The U.K. decision on whether to remain in the European Union on June 23 is also weighing on investors’ minds.

Meanwhile, the benchmark Nikkei 225 index closed down -0.4 percent at 16,601.36, and the broader Topix index also closed lower 0.50 percent to 1,330.72 points.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022