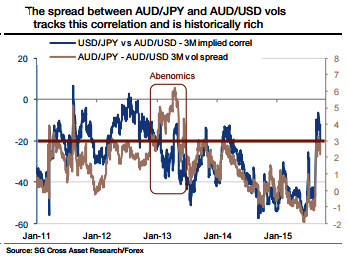

Individual volatilities suggest that the correlation between AUD and JPY should intensify. The implied correlation between USD/JPY and AUD/USD is well approximated by the spread between AUD/JPY and AUD/USD implied volatilities via triangle identities between currency pairs.

A further tightening of the spread will reinforce the negative correlation. This approximation, using only two volatilities, essentially failed when Japan launched Abenomics. At that time, the massive increase in USD/JPY volatility significantly impacted the implied correlation, so that using the three currencies of the triangle was necessary, suggests Societe Generale.

Since mid-2013, however, the correlation between USD/JPY and AUD/USD is accurately tracked by the spread between AUD/JPY and AUD/USD volatilities. This spread recently peaked at 3 vols but is showing signs of mean reversion while being still attractive.

Societe Generale recommends - Short AUD/JPY 3M volatility swap vs Long AUD/USD 3M volatility swap

JPY and AUD volatilities suggest intensifying correlations

Tuesday, September 22, 2015 6:49 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed