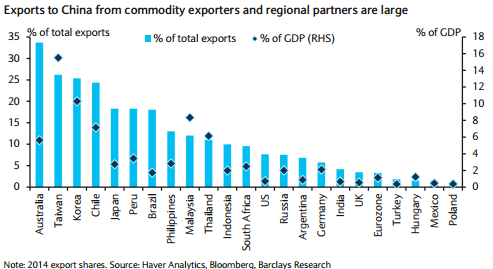

China is an important exports destination for German and Japanese, so they are likely to be vulnerable to weaker Chinese growth.

Currently, 18% of Japan's exports go to China (or 2.7% of Japan's GDP), while 6% of Germany's exports go to China (2.1% Germany's GDP), notes Barclays. The exports of both economies to the US are also large, offering some protection given robust US demand. Of course, this analysis is partial and discusses only the exposure to Chinese demand for exports.

"The move in the CNY will also have an effect on exports, imports and therefore growth prospects. Consequences of a new FX regime, the growth and inflation in Japan and the euro area will be most negatively affected among the major economies", says Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022