Japan released its consumer price index report that shows Japan's economy is struggling with deflationary pressure, which poses questions over the success of Bank of Japan's (BOJ) ultra-easy monetary policies.

Deflation fear in Japan has totally grabbed Asian market and participants' attention today. Many are now calling for BOJ to do more.

Latest report showed -

- National core CPI dropped to -0.1% in August from 0% on yearly basis. Headline Tokyo CPI dropped to -0.1% on yearly basis in September, clearly suggesting deflationary pressure.

Market expectations has been building up that BOJ and its Governor Mr. Haruhiko Kuroda will have to do more.

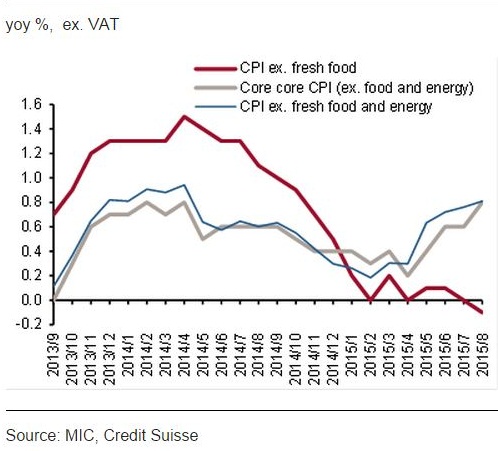

Mr. Kuroda, has been so optimistic since 2014 that when core inflation reached close to 1.5%, he went on to announce that inflation will not fall back below 1%. Now deflationary threat back in focus, most analyst think BOJ is too optimistic on its inflation targets.

Nevertheless Bank of Japan (BOJ) policymakers have it tough at one hand they have headline and core deflation but another measure that strips energy and fresh food impact from the core rose by 0.8%, which is highest level since summer of 2014. Moreover core CPI in Tokyo for September rose to 0.6% from prior 0.4%.

Yen has weakened big time today, as stocks recover and speculation over further stimulus rise. Japanese Yen is currently trading at 120.6 against Dollar.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary