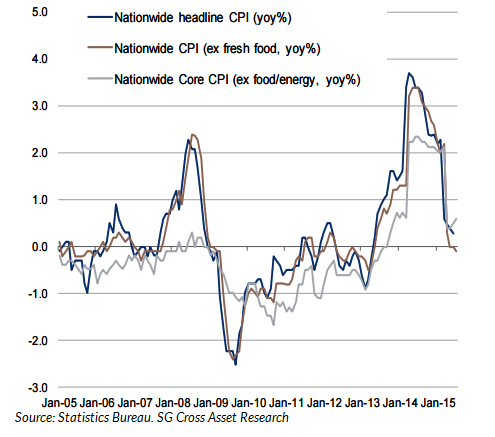

Japan's August consumer inflation data is scheduled for release on Friday and is widely expected to stay flat. The data is likely to underscore the need for BoJ to offer fresh fiscal and monetary support to bolster a fragile recovery. Core consumer prices were muted in July from a year-ago period, stalling for the first time in more than two years, coinciding with a drop in consumer spending.

"Japan's nationwide CPI (excluding fresh food) likely fell to -0.1% y/y in August (was 0.0% y/y in July)", estimates Societe Generale.

Consumers have not yet recovered completely from the deterioration in consumer sentiment after the consumption tax hike in April 2014, especially as food prices are continuously increasing. Corporates are also cautious about increasing prices as they are now aware of the rising risk that further price increases could result in the deterioration of consumer demand. Also, the second CT hike scheduled to start in April 2017 is likely to keep consumer sentiment suppressed.

"Japan's inflation is likely to weaken thanks to lower energy prices taking inflation further away from the Bank of Japan's 2 percent target," Shane Oliver, head of investment strategy and chief economist at AMP Capital, said last Friday.

The JPY has weakened versus the USD as inflation failed to take off as promised. Passing on of price increases to products as a result of cost-push inflation caused by yen depreciation and the recovery in domestic demand are indeed helping to push up inflation. Expansion of domestic demand resulting from wage increases and further yen depreciation should push up inflation to around +1.5% by the end of FY16.

However, a renewed fall in oil prices could mean that there is every chance headline inflation will turn negative in the months ahead. Since July, oil prices have been declining again. But wage growth is expected to strengthen due to tight labour supply and demand. As an effect, last year's decline in oil prices will disappear on a y/y basis and CPI is expected to rebound in Q4. However, CPI is only expected to reach around +0.5% y/y by year-end, much weaker than BoJ's target.

BoJ stresses that inflation is strengthening as a result of yen depreciation and recovery in domestic demand, which is also putting upward pressure on food costs. However, even this view will not alter the BoJ's commitment to achieve its 2% target. In October, additional QQE measures are likely to be implemented, as the BoJ realises that the pace of economic recovery and inflation are both slower than initially expected, and given the growing risk for expected inflation to fall.

USD/JPY will likely remain under pressure, given the dovish FOMC last week but will also likely remain prone to fluctuations in global risk sentiments. The dollar recovered ground against the yen on Monday as investors weighed if the Bank of Japan may ease policy after the Federal Reserve delayed a hike in interest rates. The dollar was 0.1 percent higher at 120.10 yen, recovering from Friday's low of 119.045 yen.

Japan's inflation likely to stay muted, underscores need for further BoJ support

Monday, September 21, 2015 10:48 AM UTC

Editor's Picks

- Market Data

Most Popular

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal