Whale Activity Surge Highlights TRON's Market Momentum

This week, there has been a significant increase in whale activity in the TRON (TRX) market, marked by a sharp rise in price and trading volume. The number of large transactions (over $100,000) jumped from 244 to 722 in just 24 hours from December 2 to December 3. This surge shows strong interest from institutional investors and wealthy individuals, with the total value of these transactions reaching around $432 million.

Justin Sun's Bold Claims Spark Debate

Justin Sun, the founder of TRON, made headlines by claiming that TRX (TRON's token) is equivalent to XRP (Ripple's token) after TRX surged 30% in value. This statement followed XRP's own big jump of 40% on December 2, pushing its price near $2.80. The comparison has sparked mixed reactions in the cryptocurrency community, with some supporting Sun's claim while others argue the tokens have different uses and market behaviors. As TRON's popularity grows, it will be interesting to see how this affects investor sentiment and the overall market for both tokens.

Javon Marks Predicts a TRON Price Explosion

Javon Marks, a well-known crypto trader, recently predicted that the price of TRON (TRX) could soar to $1.11, which would be a 720% increase from its current price. His optimistic view reflects the positive mood in the market for TRX and cryptocurrencies in general. Marks’ prediction has generated a lot of interest among traders and investors.

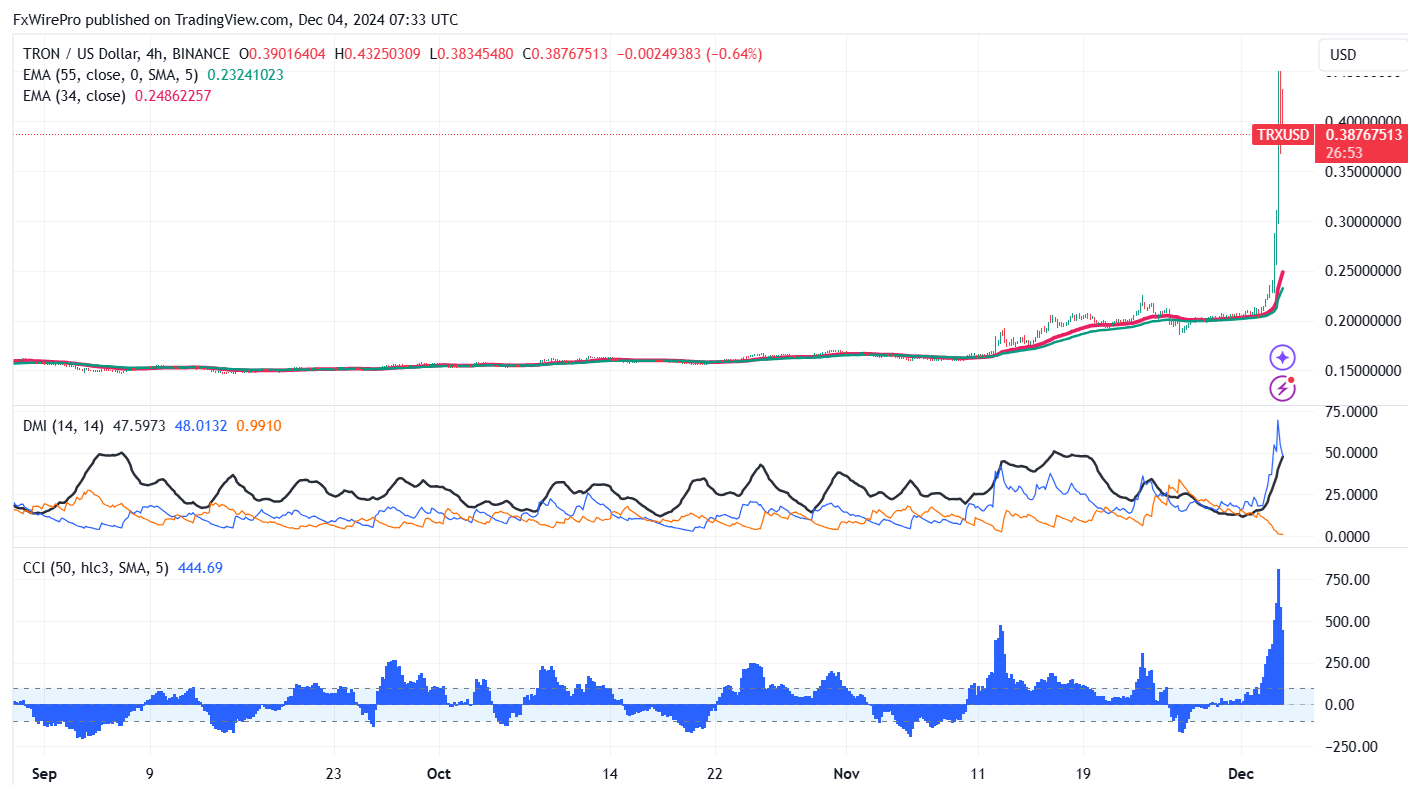

TRXUSD Price Analysis and Trading Strategy

TRXUSD prices surged more than 100% in the past week, hitting a high of $0.450 and currently trading around $0.3930. The pair is holding well above the short-term (34 and 55-day EMA) and long-term hull moving average (365-day EMA). The near-term resistance is around $0.450; a breach above this level could take the pair to 0.60/0.60/1/$1.10. On the lower side, immediate support is at $0.300, with violations targeting $0.246/$0.200.

Bullish Indicators Point to Buying Opportunities

Indicators on the 4-hour chart signal a bullish outlook, with the CCI(50) indicating strength and the directional movement index also bullish. It may be a good strategy to buy on dips around $0.30, with a stop-loss around $0.20 and a target price of $1/$1.10.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary