UK's manufacturing sector likely to weigh on bank of England's (BOE) aspiration to hike rates at turn of the year. According to Markit's report, manufacturing sector posted weakest quarter in past two years.

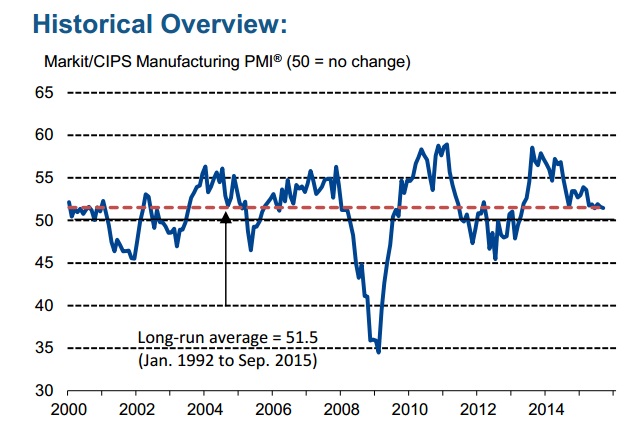

BOE members has started showing hawkish bias back in 2013, which was later scaled back due to return of weakness. This time could be similar too. After rising from 2012 end to close to 60 level in 2013, manufacturing PMI has been declining steadily since.

UK manufacturing sector was able to post gains (which is marked by reading above 50) for 30 consecutive months but September reading was weakest among the lot. In September, manufacturing PMI registered 51.5 reading compared to 51.6 in August.

Though Bank of England (BOE) members have suggested China weakness in not much of importance in terms of policy decision, data from manufacturing is saying otherwise. Growth in export orders are stagnating and the sector is facing headwinds from emerging markets slowdown.

Employment in the sector is dropping.

Moreover with cost pressure to industries at 16 year low, lowest since 1999 and dropping at fast pace it would be difficult for BOE to justify rate hike just riding on wage growth.

Pound is currently trading at 1.515 against Dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate