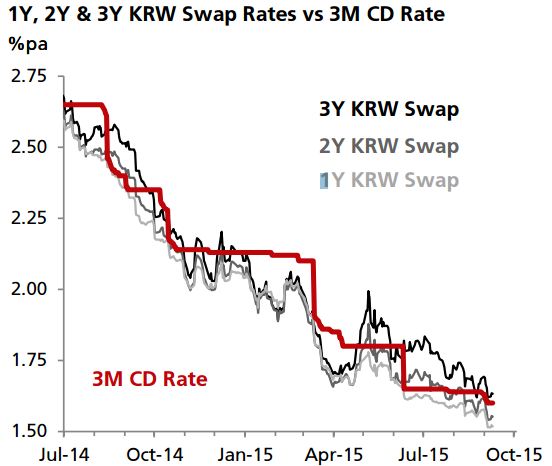

The market is pricing an outside chance of rate cuts within the next six months as sentiment on the Korean economy sours. The market is more dovish for the Bank of Korea (BoK) to keep the policy rate unchanged at 1.5% through to 3Q16.

Over the past two month, short-term KRW swaps (2Y and 3Y) have completely retraced the upmove seen in 2Q this year and are plumbing new lows. The renewed collapse in commodity prices and lackluster export demand are the two key reasons this development.

Speculation of rate cuts to prevent the KRW from being too strong versus peers was a key reason driving KRW swap rates lower. However, according to DBS Bank, this argument is no longer valid as the KRW has weakened significantly over the past few weeks, catching up with its Asian peers. Export competitiveness has become less of an issue. Moreover, with the domestic economy showing tentative signs of bottoming out, the market is likely to focus on domestic and external stability risks.

"In the absence of rate cuts, we think short-term KRW swap rates are biased modestly higher over the coming months," added DBS Bank.

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty