New Zealand Dollar is trapped in two bearish forces, one is coming from lower commodity prices and weakness In China, while another is from its central bank's aggressive monetary easing.

Since April, Reserve Bank of New Zealand (RBNZ) has reduced policy rates for three consecutive time from 3.5% to 2.75%. At least another 25 basis points rate reduction is expected this year. There are two meetings left for RBNZ this year, one in October another in December.

While outlook is still bearish for Kiwi against Dollar, key commodities for the economy needs to be monitored to have a feel of the turnaround in the economy.

Price of most of these commodities are declining in global market, though aggressive drop in Kiwi has somewhat shielded the adverse effects of the fall as many registered rise in terms on New Zealand Dollar.

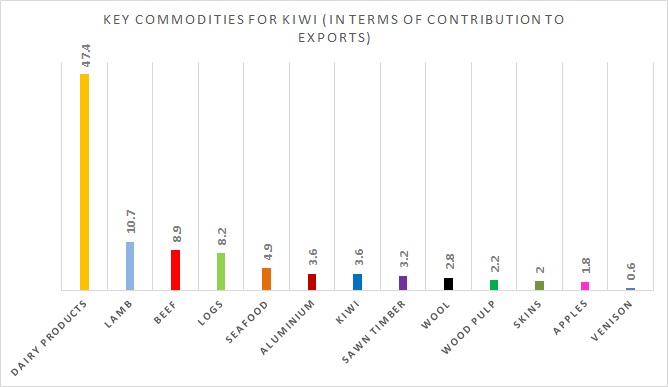

Key commodities for Kiwi and their weightages (in terms of exports)

- Importance of Dairy products highest for New Zealand economy (47.4%), followed by Lamb (10.7%), Beef (8.9%), Logs (8.2%), Seafood (4.9%), Aluminium (3.6%), Kiwi fruit (3.6%), Sawn Timber (3.2%), Wool (2.8%), Wood pulp (2.2%), Skins (2%), Apples (1.8%) and Venison (0.6%).

Kiwi has better prospect of recovery going ahead compared to its neighbor Aussie, due to the economy's dependence on soft commodities than hard ones.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?