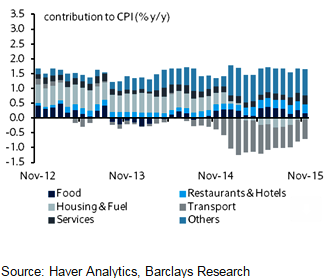

Korea's inflation for the month of November rose to 1.0% year on year, slightly above the anticipated 0.9%. Firming services and the rental market supported this strengthening of headline inflation.

Along with a small pull back from oil on the low year-earlier base, has driven the headline rate to pick up. Firming in services also supported the core inflation in November, helping it to edge up to 2.4% yoy.

"With one month left in the year, we continue to expect full-year inflation for 2015 to be 0.7% y/y and to creep up to 1.8% y/y next year. More importantly, we also expect the BoK to re-centre lower and widen its inflation target range to 1-3% from 2.5-3.5%, with effect from 2016", says Barclays in a research note.

Korea's 2015 full year inflation likely to be 0.7%yoy

Tuesday, December 1, 2015 3:42 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed