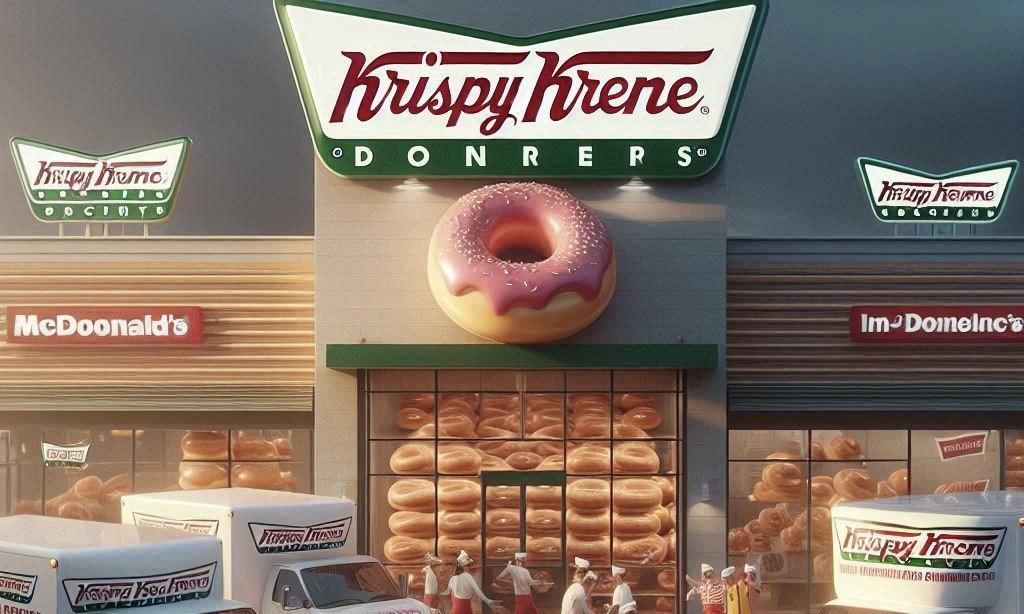

Krispy Kreme is gearing up for a nationwide rollout of its doughnuts at McDonald’s locations, beginning this fall in Chicago. To meet the increased demand, the company is modernizing its production and delivery systems, ensuring fresh doughnuts are available daily at over 1,000 McDonald’s restaurants by the end of 2024.

Krispy Kreme Invests Heavily in Nationwide Doughnut Rollout at McDonald’s, Starting in Chicago This Fall

Krispy Kreme has committed to introducing doughnuts at McDonald's restaurants across the country, and the company is making substantial investments to fulfill its commitment.

The national rollout commences in the autumn in Chicago, McDonald's hometown. Krispy Kreme anticipates it will have 1,000 restaurants by the conclusion of 2024, followed by an additional 5,000 in 2025 and 6,000 in 2026. Doughnuts would comprise 85 percent of McDonald's U.S. footprint by that time. McDonald's had 13,484 U.S. locations after Q2 and intended to expand by 900 U.S. stores by 2027.

According to Krispy Kreme CEO Josh Charlesworth, the organization is modernizing its doughnut manufacturing procedures. McDonald's is among the customers with whom a specialized team collaborates to guarantee a seamless launch. The brand is recruiting and training experts in manufacturing operations, upgrading its production lines, and continuously refining manufacturing. Furthermore, Krispy Kreme is enhancing its delivery logistics network through fleet enhancements and improved routing. Improving the distribution scope and increasing production center utilization are anticipated outcomes of this expansion initiative.

“We have a dedicated cross-functional team there to make sure the facilities and our people are ready. In fact, we’re also making improvements to the production lines and even doing our best to improve productivity and up our game as we go. We’re very focused on delivering a really high-quality service to the McDonald’s restaurants so that people get awesome fresh doughnuts every day at the same quality level they expect in Krispy Kreme and other channels,” Charlesworth said during Krispy Kreme’s Q2 earnings call.”

The partnership between McDonald's and Krispy Kreme was announced in March to expand it nationally. The introduction results from a successful test conducted at 160 McDonald's locations in Louisville and Lexington, Kentucky. Three Krispy Kreme doughnuts will be available at inside locations each day: Original Glazed, Chocolate Iced with Sprinkles, and Chocolate Iced Kreme Filled. Customers can purchase them individually or in six-packs throughout the day, provided that supplies last.

Charlesworth stated that the increase in production would only necessitate a significant increase in labor if a few dollars were allocated to marketing and the recruitment of delivery carriers.

“Our respective marketing teams are working closely together with the McDonald’s team, so that people know Krispy Kreme is coming to McDonald’s,” Charlesworth said. “So there is investment there but the overall message is that the expansion of deliver fresh daily in the U.S. is leveraging an underutilized system. The additional densification of all that distribution means you get flow through to the bottom line.”

Krispy Kreme Expands U.S. Network with New Centers, Boosting Access and Revenue Across Key Markets

Currently, an average of 50 points of access are served by 151 U.S. centers with spokes. BY 2026, Krispy Kreme anticipates that this number will surpass 100 access sites. Charlesworth cited Chicago as an illustration, stating that the company will distribute doughnuts to 450 new venues with the same number of production hubs. In addition to augmenting its current resources, Krispy Kreme intends to establish 30 additional centers in regions with restricted access to doughnuts over the next three years. Currently, 17 30 facilities are in progress, including Seattle, Minneapolis, and Philadelphia.

According to QSR Magazine, net revenue increased by $21.9 million, or 8.2 percent, in the U.S. segment, with organic revenue growth of 8.4 percent. The company stated that innovative specialty doughnut collections primarily drove revenue growth. Digital sales increased by 26 percent, while DFD door sales (grocery stores, convenience stores, restaurants, and other establishments where visitors can purchase fresh doughnuts) increased by 24 percent. The trailing 12 months saw an average of $5 million in revenue for U.S. centers. This is an increase from the $4.7 million recorded during the same period last year.

The U.S. adjusted EBITDA increased by 16.3 percent to $32.7 million, and the adjusted EBITDA margin increased by 80 basis points to 11.3 percent. This growth was driven by the hub-and-spoke model's productivity benefits and the optimization of labor and waste. McDonald's start-up costs and increased promotional activity partially offset the margin improvement.

Charlesworth clarified that Chicago was a strategic decision based on McDonald's preferences, even though it differed from the company's previous markets in Lexington and Louisville. The decision was influenced by the existing capacity of Krispy Kreme's three production centers in Chicago, which already possess the infrastructure necessary to facilitate expansion. One of these centers is an excellent starting point due to multiple production lines.

“I feel really confident about starting out in Chicago,” Charlesworth said. “We have a nice presence across the Midwest in general. So you know, get going with a really positive, strong momentum from the start makes sense for both of us. So we’re excited for the teams there.”

Krispy Kreme has significant agreements with Walmart, Target, and Kroger to supply additional doughnuts to their retail locations and McDonald's. Target has recently partnered with the brand in Atlanta and Phoenix. Additionally, there are plans to expand the network with McDonald's to include Los Angeles, Detroit, and numerous other cities.

Nevertheless, Charlesworth stated that locations with lower traffic volumes are "still very helpful to us."

“Because we think all the places you go on the way to a McDonald’s, Target, Walmart, Kroger, you’re going to be going past convenience stores, gas stations, making the logistics route efficient, and so we still see a role for those to play, but naturally, we’re focused on those big national partners that the McDonald’s program unlocks for us,” he said.

Krispy Kreme's organic revenue increased by 7.8 percent to $440.2 million, while its overall net revenue increased by 7.3 percent to $438.8 million in Q2. The adjusted EBITDA margin increased by 60 basis points year-over-year, and it increased by 12.1% to $54.7 million.

Stuck in a creativity slump at work? Here are some surprising ways to get your spark back

Stuck in a creativity slump at work? Here are some surprising ways to get your spark back  Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand

Lynas Rare Earths Shares Surge on Strong Half-Year Earnings and Rising Global Demand  Debate over H-1B visas shines spotlight on US tech worker shortages

Debate over H-1B visas shines spotlight on US tech worker shortages  Parents abused by their children often suffer in silence – specialist therapy is helping them find a voice

Parents abused by their children often suffer in silence – specialist therapy is helping them find a voice  FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules

FAA Plans Flight Reductions at Chicago O’Hare as Airlines Ramp Up Summer Schedules  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  6 simple questions to tell if a ‘finfluencer’ is more flash than cash

6 simple questions to tell if a ‘finfluencer’ is more flash than cash  Locked up then locked out: how NZ’s bank rules make life for ex-prisoners even harder

Locked up then locked out: how NZ’s bank rules make life for ex-prisoners even harder  Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal

Paramount Skydance to Acquire Warner Bros Discovery in $110 Billion Media Mega-Deal  Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates

Coupang Reports Q4 Loss After Data Breach, Revenue Misses Estimates  Yes, government influences wages – but not just in the way you might think

Yes, government influences wages – but not just in the way you might think  Every generation thinks they had it the toughest, but for Gen Z, they’re probably right

Every generation thinks they had it the toughest, but for Gen Z, they’re probably right  How to support someone who is grieving: five research-backed strategies

How to support someone who is grieving: five research-backed strategies  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot