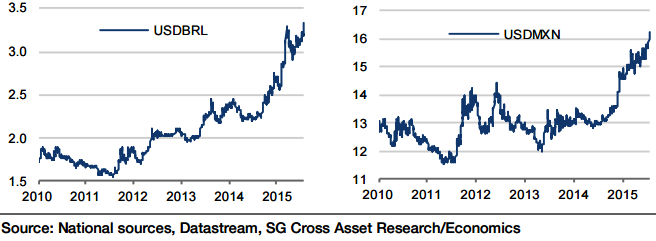

EM currencies have been under severe pressure in recent days. The JP Morgan Emerging Markets FX index has dropped to a new record low of 71.88 as EM currencies accelerate their decline.

Tumbling commodity prices amid global growth and China fears, renewed Fed fears and a deterioration of domestic fundamentals especially for Latam countries are triggering the global decline in high-yielding EM FX.

"Additionally they are highly vulnerable to any Fed rate hike due to their current account deficit positions and capital outflows. Domestic turbulences (in the case of Brazil) add to the gloomy picture for Latam that could lead to a further short-term drop of CLP, MXN and BRL of up to 10% over the next weeks", says Societe Generale.

In the current environment Latam currencies are in the centre of the storm and short Latam FX is a once-in-a-lifetime trade at this juncture. Almost allLatam countries face a rapidly deteriorating growth picture amid the drop in commodity prices.

"The USD/BRL at 3.60 and 3.60, USD/MXN at 17.0 and 16.25 and USD/CLP at 700 and 690 in Q3 and Q4 respectively", says Societe Generale.

Latam FX under severe pressure

Tuesday, July 28, 2015 7:37 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX