CFTC commitment of traders report was released on Friday (4th May) and cover positions up to Tuesday (1st May). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to nearest decimal.

- Gold – Net position long and decreasing

Long positions declined for a second consecutive week. The net long positions got decreased by 29,867 contracts to +106.8K contracts.

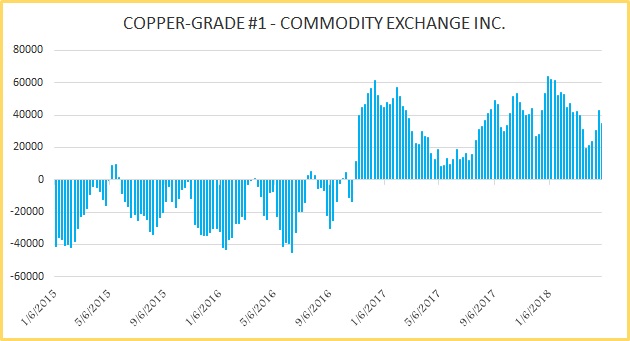

- Copper – Net position long and decreasing

Long positions declined for a fifth consecutive week. The net longs decreased by 7,720 contracts to +34.9K contracts.

- Silver – Position shifted from short to long

The short positions declined in such a fashion and by 19,163 contracts that the net position turned short from long to -7.2K contracts.

- WTI Crude – Net position long and decreasing

Speculators reduced long positions for a second consecutive week and by 21,696 contracts, which brought the net positions to +690.7K contracts.

- Natural gas – Net position short and decreasing

Short positions declined for a second consecutive week and by 1,378 contracts that pushed the net position to -94.8K contracts.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX