CFTC commitment of traders report was released on Friday (31st May) and cover positions up to Tuesday (28th May). The COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to the nearest decimal.

- Gold – Net position long and decreasing

The net long positions declined by 2,117 contracts that pushed the net potion to +86.7K contracts.

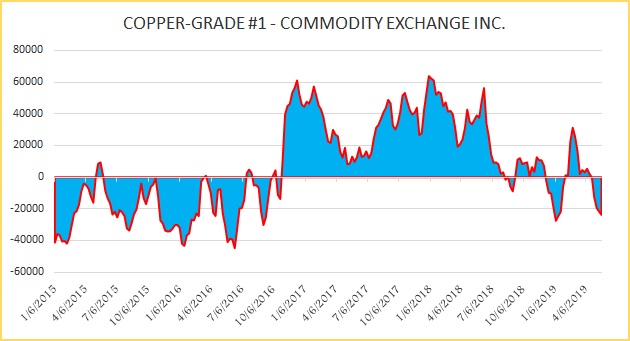

- Copper – Net position short and increasing

The net short positions rose by 2,114 contracts that pushed the net potion to -23.8K contracts.

- Silver – Net position short and increasing

The net short positions rose by 7,747 contracts that pushed the net positions to -22.4K contracts.

- WTI Crude – Net position long and decreasing

Speculators reduced long positions by 39,460 contracts, which brought the net positions to +438.9K contracts.

- Natural gas – Net position short and decreasing

The net short positions declined by 24,973 contracts that pushed the net potion to -85.9K contracts.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022