CFTC commitment of traders report was released on Friday (18th November) and cover positions up to Tuesday (15th November). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to nearest decimal.

- Gold – Net position long and decreasing

After three consecutive weeks of gains in the long positions, traders reduced their long bets sharply last week. The net long position decreased by 39,578 contracts to +177.7K contracts.

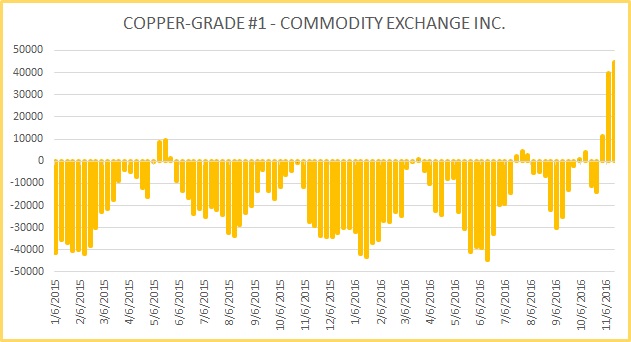

- Copper – – Net position long and increasing

Traders increased their net longs for third consecutive week. The net longs increased by 5,359 contracts to +45K contracts.

- Silver – Net position long and decreasing

The net long position decreased in silver last week. The net longs declined by 2,663 contracts to +62.6K contracts.

- WTI Crude – Net position long and decreasing

The net long positions decreased marginally last week as traders reduced the net long positions by 1,213 contracts to +276.3K contracts.

- Natural gas – Net position short and increasing

Traders increased their short bets for a third consecutive week. Net-short positions rose by 17,294 contracts to -90.9K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX