CFTC commitment of traders report was released on Friday (22nd July) and cover positions up to Tuesday (July 19th). COT report is not a complete presenter of entire market positions, however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to nearest decimal.

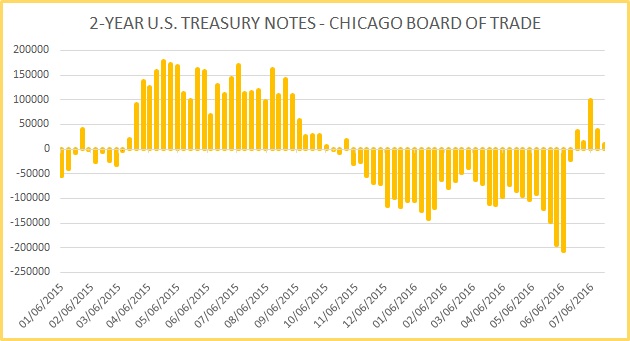

- 2 year U.S. Treasury:

Traders decreased their net longs in 2-year treasury sharply as economic data showed economic recovery ongoing. The net-long positions decreased by 27,770 contracts to +10.5K contracts.

- 5 year U.S. Treasury:

5-year treasury saw an increase in net short position by 24,736 contracts, and thus bringing the net position to -149K contracts.

- 10 year U.S. Treasury :

Speculators decreased their net long positions by 21,990 contracts to +109.4K contracts.

- S&P 500 (E-mini) –

S&P 500 saw a very large increase in net longs. Net longs got increased by 75,561 contracts and thus bringing net position to +146.2K contracts.

- Russell 2000 –

Russell 2000 saw a large decrease in net short positions, where net shorts were decreased by 12,622 contracts to -17.6K contracts.

- MSCI Emerging Markets Mini Index –

Investors increased their exposures to EM very sharply as speculative net longs were increased by 38,942 contracts to +157.5K contracts.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed