CFTC commitment of traders report was released on Friday (31st May) and cover positions up to Tuesday (28th May). The COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to the nearest decimal.

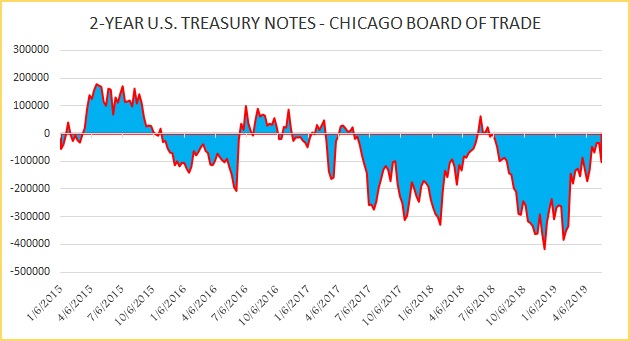

- 2 year U.S. Treasury:

Speculators increased short positions for the 7th time in 15 weeks. Short positions rose by 68,892 contracts that led to a net position of -102.8K contracts.

- 5 year U.S. Treasury:

5-year treasury short positions declined last week and by 57,239 contracts that brought the net position to -111.4K contracts.

- 10 year U.S. Treasury:

Speculators increased short positions for the week, and by 47,178 contracts to -376.2K contracts.

- S&P 500 (E-mini) –

Speculators reduced long positions last week and by 8,400 contracts to +92.3K contracts.

- MSCI Emerging Markets Mini-Index –

Long positions declined in the week ending May 28th and by 6,620 contracts that pushed the net position to +154.2K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022