CFTC commitment of traders report was released on Friday (26th July) and cover positions up to Tuesday (23rd July). The COT report is not a complete presenter of entire market positions since the future market is relatively smaller compared to the Spot FX market. Nevertheless, it presents a crucial picture of how key participants are looking at future moves.

Key highlights:

Market participants are net short in all currencies against the dollar except the Mexican peso and the Canadian dollar.

Short positions increased:

- The short positions in the British pound rose by 2,226 contracts to -78.6K contracts.

- The short positions in the Swiss franc rose by 1,461 contracts to -13.2K contracts.

- The short positions in the euro rose by 7,653 contracts to -39K contracts.

Long position decreased:

- The long positions in the Mexican Peso declined by 3,366 contracts to +124.8K contracts.

- Long positons in the Canadian dollar rose by 9,786 contracts to +30.8K contracts.

Short positions decreased:

- The short positions in the New Zealand dollar declined by 5,094 contracts to -12.2K contracts.

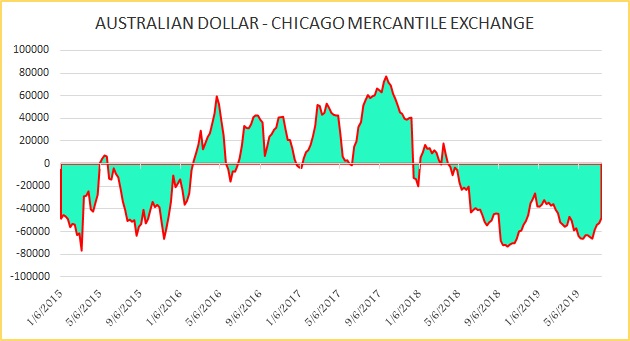

- The short positions in the Australian dollar declined by 4,596 contracts to -48K contracts.

- The short positions in Japanese yen declined by 2,003 contracts to -9.4K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed