Federal Reserve (FED) is about to hike rates this year after almost 9 years since the last rise. Current rate is maintained close to zero percent. The most probable next hike would be to bring the Fed funds rate to range of 0.25%.

- FED raised rates in 2004 from 1% to 5.25% by 2006. During which performance of the asset class remained mixed.

- Dollar index traded within a range between 80 to 90. So FED raising rates not necessarily mean a strong dollar, but this time it could be different as the major central banks' monetary policies are diverging unlike then.

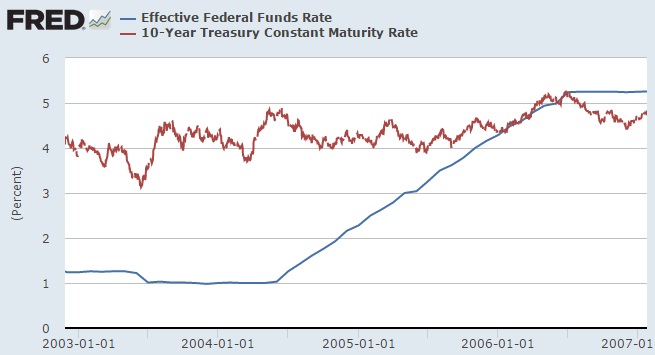

- The attached chart explains the relation of the longer end treasury namely 10 year yield with FED funds rate for the period of previous rate hike, during which the FED funds rate saw rise of 425 basis points, whereas the treasury yields moved only 50 basis points.

- This may not hold true completely this time, as the yield differential between the FED and the 10 year was much larger than the current.

- Still, it may be unwise to bet heavily against the longer end, once the FED actually begins.

- Partial curve steepening could occur at some point ahead, however more could be parallel shifts.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate