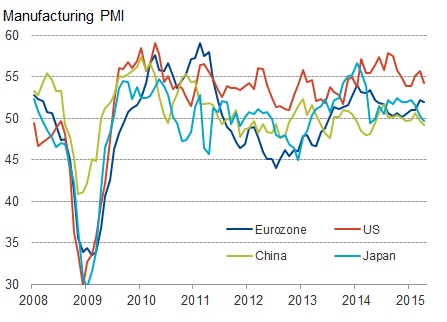

Yesterday's provisionary April PMI report might have cheered the bears calling for an end to recovery, however it would be premature to call for such, in spite recent weakness.

PMI above 50 indicates growth.

- Japanese PMI dropped to 49.7 from 50.3 prior.

- Chinese PMI dropped further in negative growth zone to 49.2 from 49.6 prior.

- Euro zone manufacturing PMI dropped to 51.9 from 52.2

- US manufacturing PMI dropped to 54.2 from 55.7 prior.

However, don't read too much into the weak PMI, growth historically has been uneven similar to market's rise and fall. World as of now, is far past the crisis slump and economic activities will keep improving over the coming time.

- New export orders continue to rise for tenth consecutive month in Japan. Employment also improved.

- Export orders reversed course in China, ending its three months of consecutive drop.

- April registered strongest monthly gains in employment across Eurozone, manufacturing slowed but business at service sector continue to improve at solid pace.

- Despite headwinds from dollar, production volume still moving up and employment remains solid across sectors in US.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand