Bank of Thailand (BoT) has kept its interest rate unchanged at 1.5 percent since June 2015. The central bank is more inclined to maintaining loose monetary conditions via a weaker THB rather than lower rates. And with two central bank meetings remaining for this year (in November and December), we see little probability of another cut in 2016.

Thailand's headline inflation was -0.9 percent in 2015 and the nation continues to face disinflationary pressures. Given the modest economic recovery and low oil prices, analysts expect inflation to stay around 0 percent and 0.8 percent in 2016 and 2017 respectively, which is still at the lower end of BoT’s 1-4 percent medium-term target for headline inflation. However, BoT has downplayed the deflationary risks, stating that core inflation is still holding around 1 percent.

After growing by a mere 0.9 percent in 2014 due to political uncertainty, Thailand's economy is expected to expand by a respectable 3.1 percent in 2016 from 2.8 percent in 2015. The domestic sector is likely to be the main driver. However, the buildup in household debt may constrain domestic consumption. That said, government's support to large scale infrastructure projects and continued political stability could help revive investment spending and see a more sustainable recovery.

In H1 2016, the economy grew 3.4 percent and the government is projecting a growth of 3–3.5 percent for the year 2016. Commerzbank currently projects 2017 growth of 3.2 percent.

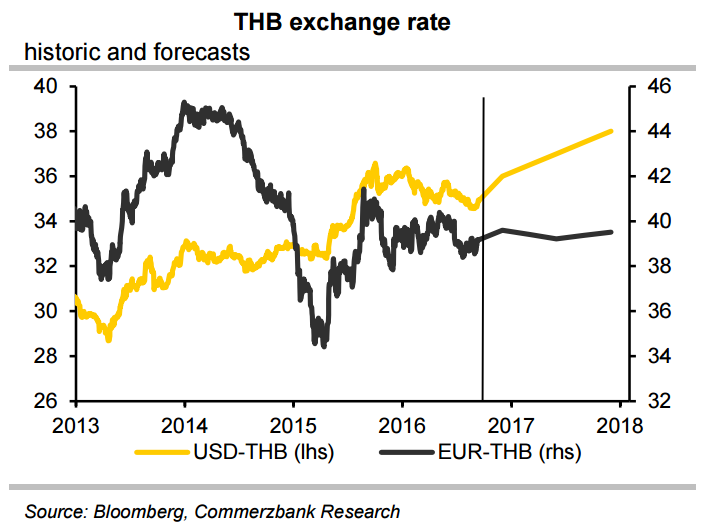

A broadly stronger USD on the back of rising hopes of a Fed rate hike, BoT’s preference for a weaker THB and persistent political uncertainty have weighed on the THB. THB was the third worst performing currency in Asia in 2015 and on account of the above-mentioned reasons is likely to remain on a weakening trend. Commerzbank forecasts USD-THB at 36.00 by end-2016.

USD/THB was 0.73 percent higher on the day. The pair was trading at 35.72 at around 12:00 GMT. Technical indicators suggest further upside. 20-period weekly MA at 34.96 is major support on the downside. Weakness could resume only on break below. On the upside we see next hurdle at 35.80 levels. Break above will see test of 36.67 levels.

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand

Gold Prices Rebound Near Key Levels as U.S.-Iran Tensions Boost Safe-Haven Demand  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs

Japan’s Agricultural, Forestry and Fishery Exports Hit Record High in 2025 Despite Tariffs  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence