Chinese stock market post another frenzied rally of 2% today, however economic fundamentals for the country remains in troubled water.

- China reported positive yearly CPI gain however that remains far away from levels targeted by country's central bank around 3%. Officials have reduced targeted inflation this year by 50 basis points. Chinese CPI gained 1.4% gain in March y/y, however dropped -0.5%m/m compared to prior 1.2% gain prior.

- Producer price index continues decline for more than three years, now in its 37th month. Producer price index dropped. Little can be blamed on lower oil prices for such a long decline. Weakening growth in Chinese domestic demand from housing sector is contributing to it. PPI declined -4.6% in March.

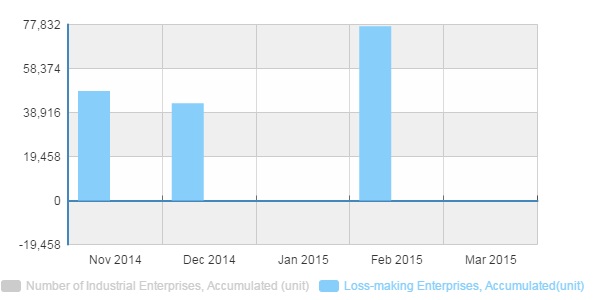

On a separate note, as shown in the chart number of loss making enterprises has gone up in February as per latest data available.

Total loss making enterprises now stands around 2% of total enterprises as of February, up from 1% in December 2014.

Weaker inflation is posing would lead to further rate cut by PBOC that keeps fueling the country's stock market.

Chinese Yuan has sharply jumped after making 6.12 low against dollar, currently trading at 6.21.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?