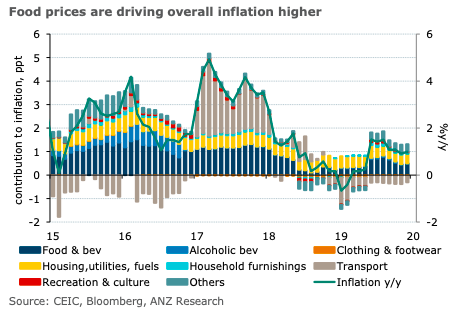

Malaysian inflation is expected to rise in the coming months due to a low bas despite the delay on floating RON95 grade petrol prices, according to the latest report from ANZ Research, after having picked up to 1.0 percent y/y in December on the back of a seasonal uptick in ‘food’ prices.

On a sequential basis, headline inflation in December increased 0.2 percent m/m. A seasonal uptick in ‘food’ prices (0.5 percent m/m), contributed to the bulk of the rise in the overall index. The ‘transport’ and ‘restaurants and hotels’ components also contributed modestly.

On an annual basis ‘transport’ costs contracted 1.9 percent y/y in December, lower than the 2.4 percent y/y contraction in the previous month. Another delay on the shift to floating RON95 grade petrol prices will limit the sequential impact of higher global crude prices in January.

Nonetheless, a low base last year implies that annual growth in the ‘transport’ component will likely turn positive from January, reversing the drag on overall inflation that has persisted for 14 consecutive months.

On an annual basis, core inflation remained unchanged at 1.4 percent y/y in the month. The prospects of a tech cycle upturn and a rebound in public investment spending have made possibilities of a more constructive growth in 2020, the report added.

"Though the floating of RON95 prices has been delayed, low base effects should prop up headline inflation to around the ~1.5 percent mark over the next few months," ANZ Research further commented in the report.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022