The Bank Negara Malaysia (BNM) in its first monetary policy meeting of 2017 on 16th January held its benchmark overnight policy rate at 3.00 percent and said that the decision was supported by stronger household demand, higher inflation prospects and weak MYR. In the monetary policy statement that followed BNM noted that the private sector activity will be the key driver of economic growth and committed to continuously inject liquidity to ensure stable FX market.

Data released in February showed the pace of contraction in Malaysia’s manufacturing sector eased in January, indicating that the manufacturing sector had come through the worst of its downturn. Malaysia's headline Nikkei manufacturing PMI index rose to 48.6 in January from 47.1 in December. The pace of contraction in production also decelerated to the weakest since May 2015. Business confidence also rose to a four-month high at the beginning of 2017.

Meanwhile, employment in the sector stayed in the expansion territory for the fifth straight month. However, the pace of job creation slowed further and was just marginal. The weak ringgit aided in stimulating exports, but at the same time it continued to put upward pressures on cost burdens, with input prices rising at the most rapid rate in the series history. Prices charged rose at the sharpest pace since May 2016.

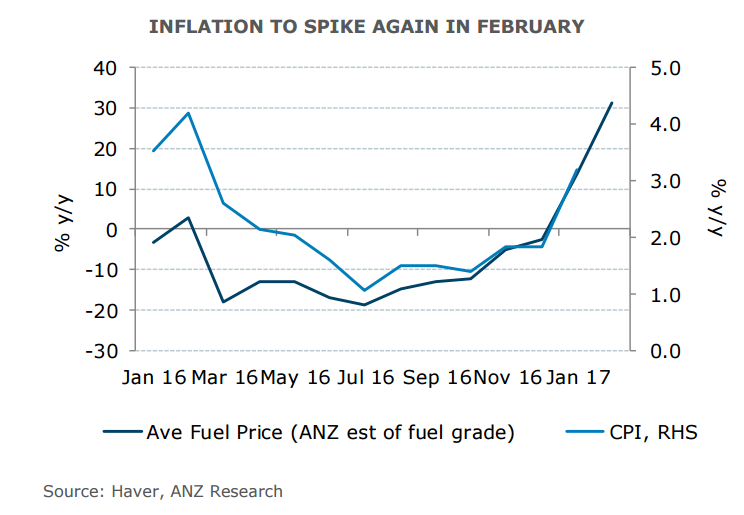

Malaysia’s headline CPI spiked in January owing to higher domestic fuel prices. Data released earlier on Wednesday showed Malaysia’s headline CPI spiked to 3.2 percent in January from 1.8 percent in December, much higher than consensus forecasts at 2.7 percent. Transport costs rose a significant 8.3 percent y/y in January while food price inflation (which has a 30.2 percent weight in the CPI basket) also increased 4.0 percent y/y during the month, partly due to removal of subsidies for essential items such as cooking oil. Going forward, Malaysia’s inflation is likely to continue to edge higher in February as oil prices continue their grind higher. Analysts at ANZ Research expect inflation in February to rise to 4 percent y/y.

Currency stability will be a key focus for the central bank in the near term. Downside risks to growth due to global uncertainties remain, but a recent upturn in some indicators including exports will allow the central bank to breathe more easily. Hence the inflation spike by itself is unlikely to elicit a policy response from BNM.

"We expect Bank Negara Malaysia (BNM) to maintain their benchmark overnight policy rate at 3.00% at their upcoming policy meeting on 2 March as economic activity has evolved in line with expectations," said ANZ Research in a report.

The Malaysian ringgit was extending range trade against the US Dollar at 4.4555 at 0930 GMT. FxWirePro's hourly USD strength index was slightly bullish at 53.1002. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality