Malaysia's economy has taken sharp blow, with drop in commodity prices. Energy has been Malaysia's one of the top export commodities along with Palm oil, for which China is its biggest customer.

All the latest forecast (including one from OECD) is pointing to further deterioration in China, with some fearing recession in 2016.

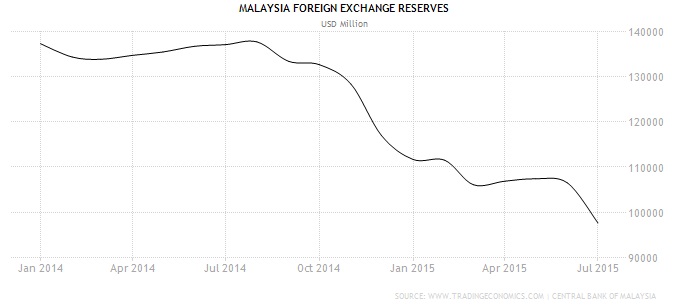

With further slowdown in China, Malaysia's weak foreign exchange reserve position likely to deteriorate fast.

As of latest data, FX reserve has fallen below $100 billion and has now moved to $96.7 billion, close to its all-time low of $82.5 billion back in 1997. Data is till July 31st. Country faced FX reserve drawdown of $40 billion in about a year.

FX reserve must've fallen further, given China's devaluation of Yuan by almost 2% in August. There are high concentration (close to 20%) of Yuan in Malaysia's FX reserve. That portion is not likely to come in handy given lack of liquidity and acceptability of Yuan.

As of now, Malaysia can finance little over 6 months of imports with its FX reserve.

Malaysian Ringgit is currently trading at 4.251 per Dollar, further depreciation likely.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary