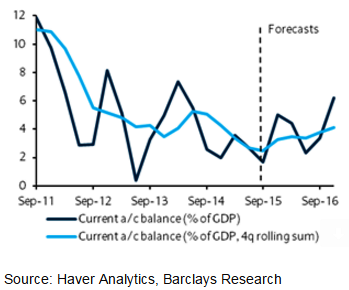

Malaysia's current account remains in a firm surplus, despite the trade shock's negative terms. In 2015, the current account surplus is manageable, at MYR5.1bn in the third quarter, and MYR 22.6bn YTD, which is 2.7% of GDP.

Moreover, MYR weakness is causing a rebalancing of the country's external position. The import demand is beginning to weaken, which is coming from a decline in capital imports, which grew at a rapid pace over the past five years but are now starting to slow and the trade surplus is seen improving.

This might cause a turnaround in current account surplus, which was weighed by low commodity prices. The capital outflows are likely to soften ahead, as FDI portofolios are pushed back by some domestic institutions.

"We now expect Malaysia's current account surplus to be 3.4% of GDP in 2016, down from 4.5% of GDP in 2015", says Barclays in a research note.

Malaysia's current account firmly in surplus

Friday, November 13, 2015 5:10 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX