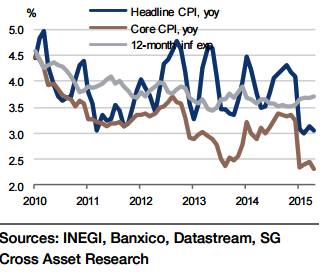

Mexican inflation slipped below 3.0% (Banxico's target) in May for the first time in a decade and has continued to fall over the past three months, as core inflation remained at its lowest level ever at 2.3% and food inflation fell. While core inflation has bottomed out, food (and to some extent transport) inflation remains the key downside risk to near-term inflation numbers.

"Moreover, it is difficult to factor in a significant rise in core prices over next few months given the low wage pressure and substantial output gap. Finally, MXN pass-through remains low and cannot push up inflation significantly. For August, the monthly series is expected to print at 2.62% yoy (0.24% mom) as the bi-weekly series will likely fall further to 2.60% yoy (0.18% mom)", says Societe Generale.

Headline inflation has slipped significantly below Banxico's 3.0% target post the sharp decline in January due to low inflation in the housing segment, the key component of core inflation. Given these developments, and the growth weakness in H1, we do not see anything seriously disturbing the status quo.

"Inflation is expected to rise only modestly over the next 12 months and have therefore cut our 2015 inflation forecast to 2.9% from 3.2%, but 2016 inflation is forecasted at 3.5% from 3.4%. Inflation is expected to revert to its medium-term trend in 2016 when the base effect of lower telecom and energy prices ebbs", added Societe Generale.

Essentially, the inflation situation remains conducive to Banxico's current accommodative stance, and growth and the Fed's stance are likely to be key factors in monetary policy decisions over the next couple of quarters.

Mexican inflation continues to fall at moderate pace as core prices remain weak

Tuesday, September 8, 2015 5:09 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022