Mexico's seasonally volatile food inflation has also moderated and most other categories have seen nearly no significant upward pressure. Looking ahead, any major factor has not been seen disturbing this set-up in the near term as the prevailing output gap, lower wage growth and low MXN pass-through are likely to keep inflation in check.

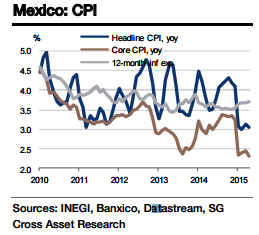

Owing to ongoing weakness in Mexico's core prices and moderation in seasonally-volatile components, particularly food, inflation fell below the target in May. However, based on the price trend through mid-June and considering the seasonal trough in food prices, headline inflation is expected to inch up in June to 2.91%, and that inflation moved closer to the target during the second half of the previous month, says Societe Generale.

Core inflation remains weak given low housing inflation and the low inflation in certain goods categories, and is less likely to recover through this year. Inflation broadly remains close to Banxico's target level of 3.0% post the sharp decline in January due to the end of long-distance telephone charges and lower transport inflation.

As a result, growth in aggregate demand will remain the key driver for both inflation expectations and monetary policy in the medium term. Inflation is expected to remain close to Banxico's target through most of this year but rise above it next year when core prices recover from current lows.

"Inflation is estimated at 3.2% in 2015 and 3.4% in 2016. Core inflation will rise to 3.2% in 2016 from 2.6% this year", added Societe Generale.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022