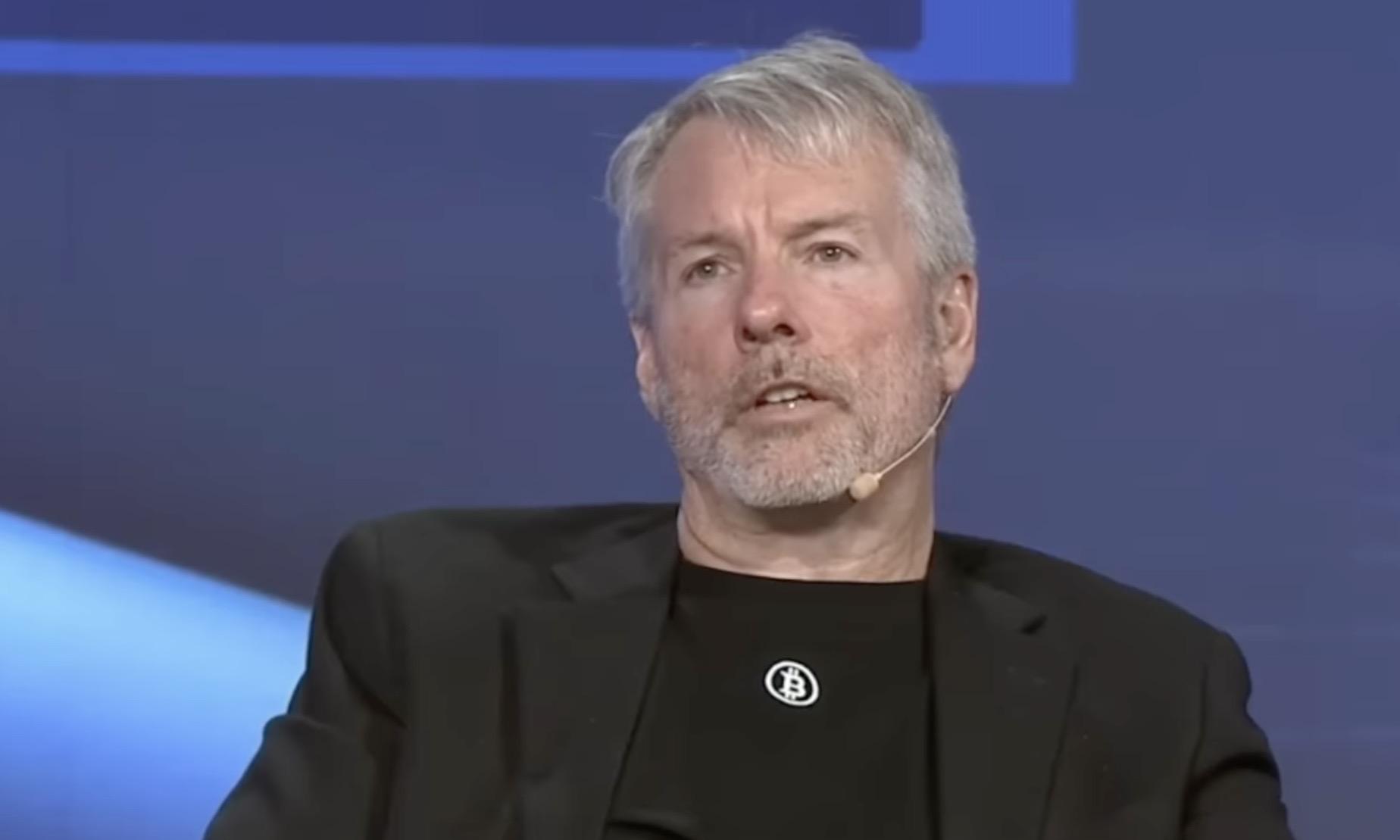

Michael Saylor, the prominent bitcoin advocate and chairman of MicroStrategy, has capitalized on the company's robust stock performance this year, selling shares worth nearly $370 million. His strategic stock sales coincide with a significant upswing in MicroStrategy's valuation, driven largely by its substantial bitcoin holdings.

Michael Saylor Capitalizes on MicroStrategy's Surge, Selling Shares Amidst Crypto Boom

MicroStrategy creator and bitcoin evangelist Michael Saylor agreed to a stock-sale agreement with his company last summer, allowing him to sell up to 400,000 shares in the first four months of 2024.

It was an appropriate compromise for the 59-year-old cryptocurrency billionaire.

With the plan more than 90% complete, Saylor has earned almost $370 million from this year's stock sales, thanks to the skyrocketing value of MicroStrategy, which is practically a Bitcoin holding firm.

Saylor, who founded MicroStrategy in 1989 as a software and technology consulting firm and continues to serve as chairman, has emerged as a Bitcoin hero in recent years. Last month, he told CNBC that cryptocurrency would "eat gold."

His company has used its balance sheet and capital markets to acquire more than 214,000 bitcoins since announcing its strategy to enter the crypto market in mid-2020.

These assets, which amount to about 1% of the entire number of bitcoins created to date, are currently worth approximately $13.6 billion, accounting for most of MicroStrategy's $21.3 billion market capitalization.

The stock has been a Wall Street darling recently, rising 91% this year — despite a 37% drop from its March peak — after skyrocketing 346% in 2023, making it one of the top performers in the US stock market.

Saylor is MicroStrategy's largest stakeholder, with Class B assets worth around $2.3 billion. An option granted to him in 2014 gave Saylor an additional 400,000 Class A shares by the end of 2023, which he is selling quickly.

Buried near the end of its third-quarter earnings filing on Nov. 1, MicroStrategy announced that the company and Saylor had entered into an agreement, known as a 10b5-1 plan, in September. The agreement allowed the founder to sell up to 5,000 shares per trading day from Jan. 2 to April 25 this year, for a total of 400,000 shares. The shares were attached to a "vested stock option, which expires if not exercised on April 30, 2024."

According to records, Saylor has sold 370,000 shares for $372.7 million this week. As of Thursday's sale, his Class A holdings had dropped to 30,000 shares.

MicroStrategy's Saylor Sells Stock Amidst Speculation; Analysts and Investors Clash on Motives

Mark Palmer, an analyst at Benchmark, described the stock sales as "entirely programmatic" due to the trading strategy implemented last year, which does not indicate Saylor's confidence in MicroStrategy or his view on the stock price.

However, retail investors have a different perspective. Several Reddit posts hint that Saylor is selling for other reasons, with some users of the r/MSTR forum believing he is using the funds to buy Bitcoin directly. Some say they are selling alongside Saylor. The stock was down 29% in April, while bitcoin was down 11%.

Palmer, who has a "buy" rating on the company, responded that such a viewpoint "would be a misread" by investors and traders.

“What we’re seeing here is very straightforward and all of it’s been disclosed already,” Palmer said. “It’s easy for those who either may not understand the details or those who understand the details but might have a short on the stock to twist things around a bit. As is typically the case, it’s easy enough to find the truth.”

Even after the stock transactions, Saylor's fortune is still concentrated in his MicroStrategy Class B holdings and the 17,732 bitcoins he purchased in 2020, which are now worth approximately $1.1 billion.

Much of the increase in Bitcoin and related assets has been driven by the advent of exchange-traded funds, which got regulatory permission earlier this year and are due to halve this week. This technical event occurs every four years, decreasing bitcoin miners' payouts in half and slowing the rate at which new bitcoins enter the market.

In a market where consumers may buy bitcoin directly on numerous exchanges or select from a plethora of new ETFs, Saylor believes MicroStrategy's ongoing value is that it offers a leveraged bitcoin play without the management charge.

The corporation can raise funds to invest more in cryptocurrency, and last month announced that it had raised $782 million "to acquire additional bitcoin." The funds were raised through a convertible debt issue at 0.625% interest.

“Is there any company in the world that you wouldn’t like to invest in that could borrow $1 billion at less than 1% interest to invest in your best idea?” Saylor said on CNBC’s “Squawk Box” in March. He added that the company’s leverage leads to volatility, which “attracts capital, and we can then leverage more.”

Benchmark's Palmer stated that there are numerous reasons to stay enthusiastic about MicroStrategy, particularly with the halving approaching. Following previous halving instances, the price of bitcoin has risen.

“If I were in a situation where I had shares in MicroStrategy, this is time where I’d very much want to be holding on to them,” Palmer said.

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate