Despite stronger-than-expected flash PMIs in October published last week, the EC's economic confidence index to soften, from 105.6 to 104.7 in October. The overall picture, though, will remain positive, showing that the recovery is led by domestic demand (services, retail activities).

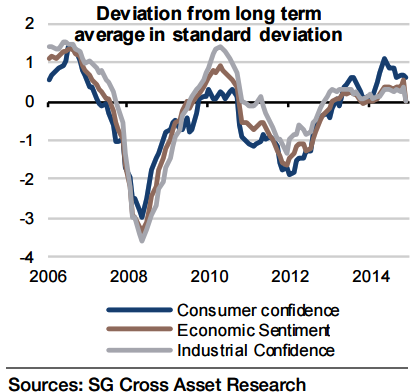

Consumer confidence deteriorated slightly (down from -7.1 to -7.7), still a high level (0.6 standard deviation above average) pointing to firm consumption growth.

"The services indicator is expected to increase from 12.4 to 12.6. Industrial confidence might slip, however, to -2.5 (from -2.2) despite the positive manufacturing PMI numbers last week. Historically, changes in the EC indicators have lagged moves in PMI figures", says Societe Generale.

The level of the economic confidence index (0.5 standard deviation higher than the long-term average of 100) would be consistent with our view that the economic recovery will be firm in H2 15.

Mixed EC economic indicators to show buoyancy despite slight softening

Thursday, October 29, 2015 5:34 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022