It will be a close call in Norway where the central bank will deliberate whether or not to cut interest rates from 1.25%.

Will it follow the example of Canada and keep rates on hold, or will it follow Australia and cut 25 bps as insurance against further falls in business investment?

An inconclusive UK election and higher oil prices argue for a short GBP/NOK position, with a break of 11.16 (200dma) opening a retreat to 11.0.

In addition, it is tracked that a Norway's sovereign wealth fund has started to systematically hedge its equity investments against currency risk amid a more volatile currency market. On Wednesday the fund's manager cleared after the fund posted its biggest ever quarterly gain measured in Norwegian kroner due to currency hedging process.

Mr.Slyngstad (Chief Executive Norges Bank Investment Management) said "While we previously wouldn't consider currency hedging our equity investments, we are now doing this systematically, we either do it directly in currency markets, or we consider equity and fixed-income investments in single countries in combination, so that if we invest more in a country, we may reduce bond holdings if we are increasing equity holdings, and so on."

He also added "Currency swings had a positive impact on the fund's Russian holdings in the Q1."

Technical watch & Derivatives radar:

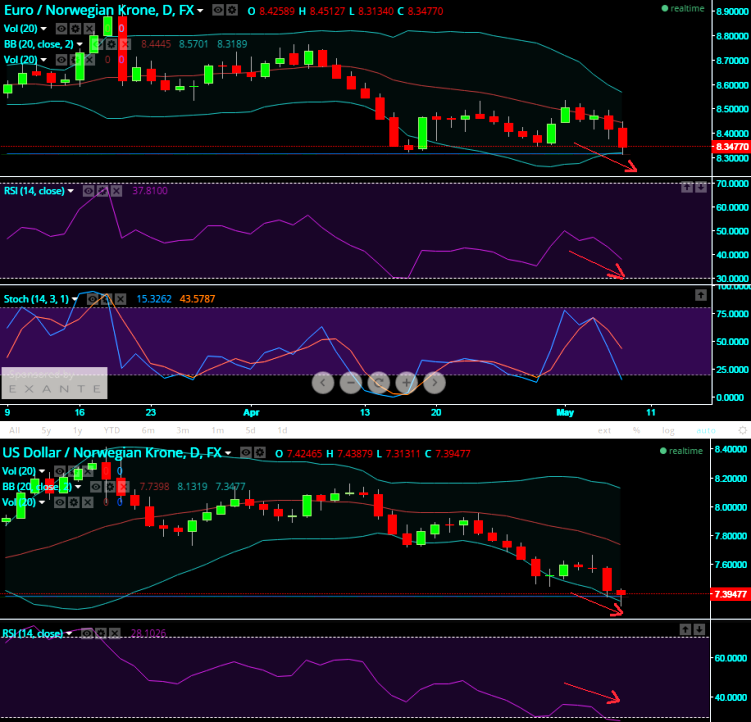

You would probably be puzzled looking at the NOK's pairing against major hard currencies such as USD, EUR, GBP & so on. Well..! We could clearly foresee a massive uptrend for these currency crosses when we figured technical charts on daily, weekly and m'ly basis.

Thus, this probable risky occurrence can be arrested either though "selling credit call spread (bear call spread)" or "buying debit spread (bear put spread)."

Bear Call Spread = Sell a Call and Purchase another Call at a higher Strike Price for a net credit.

Bear Put Spread = Purchase a Put and Sell another Put at a lower Strike Price for a net debit.

More hedging activities seen on NOK amid central bank’s policy season

Thursday, May 7, 2015 12:56 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?