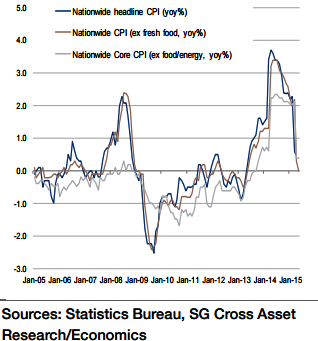

The Japan CPI was flat in April and May, pointing to stagnant inflation in recent months. Factors such as the passing-on of price increases to products as a result of costpush inflation caused by yen depreciation and the recovery in domestic demand are pushing up inflation.

"Japan's nationwide CPI (excluding fresh food) probably remained flat (0.0% yoy) in June from a year ago. However, CPI is only expected to reach around +0.5% yoy by yearend", says Societe Generale.

There will be a base effect due to last year's rise in oil prices that continued through to mid-2014. Assuming that oil prices remain at the current level, there is a risk that CPI will remain at around 0% yoy or even temporarily fall below 0% yoy.

Since April (beginning of the new FY15), the effects of upward pressure on wages have been getting stronger. In Q4, the base effect due to the fall in oil prices will fade out. As a result, prices will pick up on a yoy basis.

"A modest inflation rate and a firm wage increase should enable real wages to increase, and consumption should expand as a result. Domestic demand expansion resulting from wage increases and further yen depreciation should push up inflation to around +1.5% by the end of FY2016", added Societe Generale.

More stagnant Japan inflation in June

Thursday, July 30, 2015 5:36 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022