US events lined up today:

- US Fed William's speech is scheduled today. The Federal Reserve kept the interest rate at 0.25% during the meeting held on April 29th.

- Core CPI MoM is forecasted to remain at 0.2% where previously printed at 0.2% as well.

- Fed Chair Yellen Speech: The US inflation data is projected to offer little in the way of surprise and it's hard to see Fed Chair Yellen saying anything new, that we didn't learn from the minutes released earlier in the week.

We retain our underlying bear bias for an eventual move back to the lows, with 1.1240/75 resistance ahead of the recent highs at 1.1467.

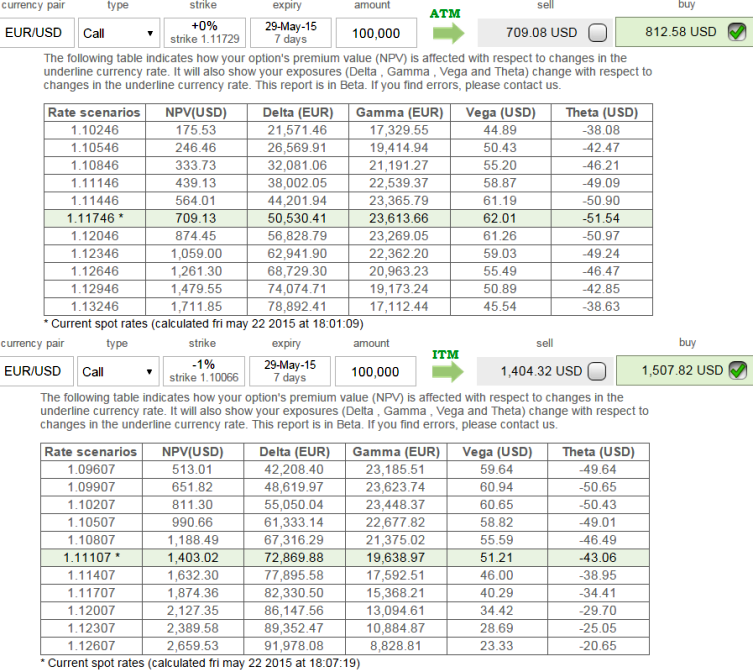

Although we've seen high OI (open interest) on ITM in option chain of this pair, NPV of ATM calls carry marginal entry point benefits.

As shown in the figure, ATM call is bought at 812.58 which demonstrates at prevailing exchange rate Net Present Value would be at 709.13

While, ITM call is bought at 1507.82 with net present value at 1403.02. So, thereby ITM call is trading at around 1.3% premium.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary