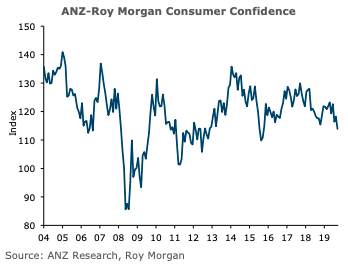

New Zealand’s ANZ-Roy Morgan Consumer Confidence Index fell 4 points to 114 in September, led by wariness of the future. The Current Conditions Index fell 1 point to 126, while the Future Conditions Index fell 6 points to 106.

Consumers’ perceptions of their current financial situation fell 5 points to a net 11 percent feeling financially better off than a year ago. A net 23 percent of consumers expect to be better off financially this time next year, down 4 points versus last month.

A net 41 percent think it’s a good time to buy a major household item, up 2. Perceptions regarding the next year’s economic outlook fell a sharp 9 points to a net 10% expecting conditions to worsen, the lowest in four years. The five-year outlook fell 7 points to +4 percent.

Sharp falls in confidence in Wellington (down 10) and Canterbury (down 6) led the drop in the index, but Wellington is nonetheless still the most optimistic region. Confidence fell in every region. House price inflation expectations are now weakest in Auckland (2.0 percent, down 0.7 percentage point) and strongest in Wellington (3.8 percent, up 0.2 ppt). General inflation expectations remained in recent ranges at 3.5 percent.

"Despite the fall, one shouldn’t overstate the weakness in consumer sentiment. Households are still feeling pretty robust. Lower interest rates are likely behind the robustness in the proportion of people thinking it is a good time to buy a major household item. The tight labour market is another key support, though employment indicators have deteriorated markedly, so this is a vulnerability going forward," ANZ Research further commented in the report.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022